Weekly Outlook on Copper - 16 August 2022

Last Updated: 10th December 2022 - 03:38 pm

The Copper prices gained 4% during the week followed by improving demand prospects due to stronger than expected data from the United States and China were reinforced by a lower dollar.

Improvement in China’s July data includes Car sales increased by 29.7% YoY basis. Copper imports rose to 463,693 tonnes in July, up 9.3% from a year earlier as the sharp drop in prices, triggered buying.

SHFE Copper stockpiles are at 1-1/2 year low, while fall in LME inventories by 30% since May, also supported the price action. US jobs growth, which accelerated unexpectedly in July, has boosted expectations of another 75 basis point rate hike in September when the Federal Reserve next meets.

However, Chinese consumer & product price index for July month were lower than the expectation due to sluggishness in the economic activities.

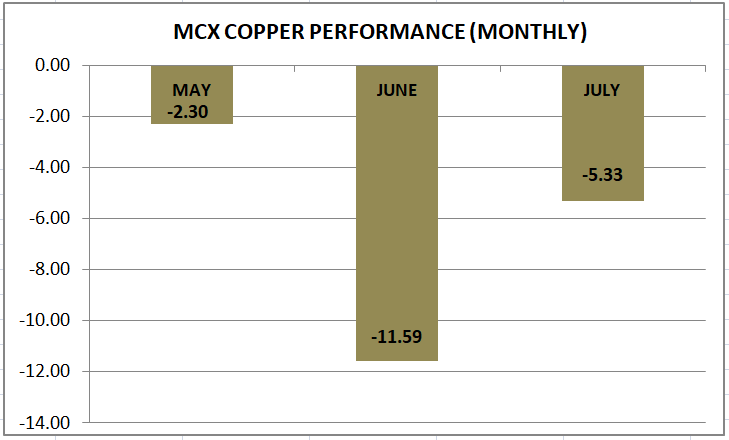

MCX Copper performance of last three months:

LME Copper witnessed a sharp up move from $7653 to $8211 in last two weeks and managed to settle above $8000 mark. On a weekly chart, the price has moved above the prior swing highs and raised more than 4% on a weekly basis. Overall, the Copper has support at around $7940 levels while; the resistance level comes at $8350/8600 levels.

On the MCX front, the Copper prices traded higher throughout the week and formed Bullish Marubozu Candlestick on a weekly chart. The price has also moved above the immediate resistance of Rs.659 with good volume participation that suggests a buying interest among the traders. Moreover, the price has also sustained above 50-Days Simple Moving Averages and RSI (14) accelerated above 60 levels, which indicates bullish momentum for the near term. However, the ongoing sentiments & news flow remains mixed, which may cap the pullback rally further. Hence, we are recommending buy on dips strategy for the coming week. On the higher side, the Copper may find the resistance around Rs. 710/723 levels. While on the downside, the support comes around Rs. 650/636 levels.

|

MCX COPPER (Rs.) |

LME COPPER ($) |

|

|

Support 1 |

650 |

7940 |

|

Support 2 |

636 |

7600 |

|

Resistance 1 |

710 |

8350 |

|

Resistance 2 |

723 |

8600 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Commodities Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Tanushree Jaiswal

Tanushree Jaiswal