Weekly Crude Oil Report

Last Updated: 14th December 2022 - 09:12 pm

Crude Oil prices extended its losses for the third straight week in a row as fear of recession and the hamper fuel demand dampened sentiments. Over the week, the WTI Crude Oil prices crashed more than 7% to trade around $106 a barrel. While Brent Oil futures plunged around 5% to trade at $108 a barrel.

After two days of meeting, The OPEC+ group of producers, including Russia, agreed to stick to its output hikes in August. However, the producer club avoided discussing policy from September onwards. Previously, OPEC and its allies had decided to increase output each month by 648,000 barrels per day (bpd) in July and August, up from a previous plan to add 432,000 bpd per month.

Technically, the NYMEX Crude Oil is forming a Head & Shoulder Pattern, which may confirm its breakdown below $102 levels. Moreover, the price has already been trading below its 100-Days Simple Moving Averages that points-out further weakness in the near term. On the downside, it has an immediate support at $102 levels while on the upside; the resistance is intact at $115. The sentiments may remain bearish below $102 level for the target of $95 & $93.

On the domestic front, MCX Crude Oil prices slipped almost 5% on a weekly basis. Overall, the price has started to correct from 9635 levels mid of June month, after forming the Bearish Engulfing pattern and it has retreated more than 12% in last three weeks.

On a weekly chart, it has formed a Doji candlestick, which indicates indecisiveness among the traders. Moreover on the daily time frame, the price has traded below the Rising Trendline & 50-Days SMA that suggest downward move for the near term.

The momentum indicator RSI (14) is also moving below 50 mark. So based on the above parameters, one can go short in Crude Oil July future below 8200 levels for the downside target of 8000 & 7700 levels. However, on the upside, 9000 level would act as resistance for the counter.

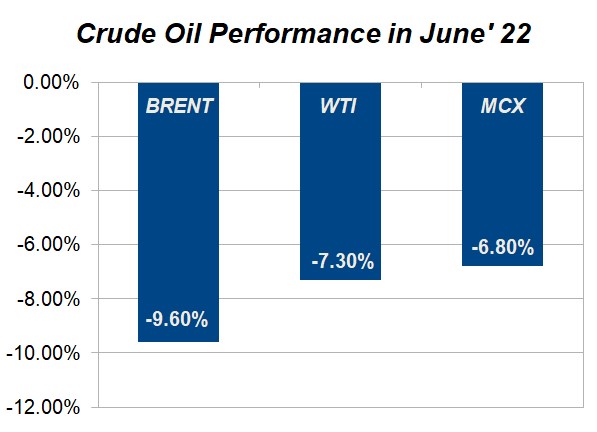

Crude Oil Price Performance in June Month:

Global Crude Oil prices witnessed sharp decline during the month of June’22, due to fear of recession & dampened demand. The OPEC & its allies also agreed to increase the output, which may keep the prices under pressure.

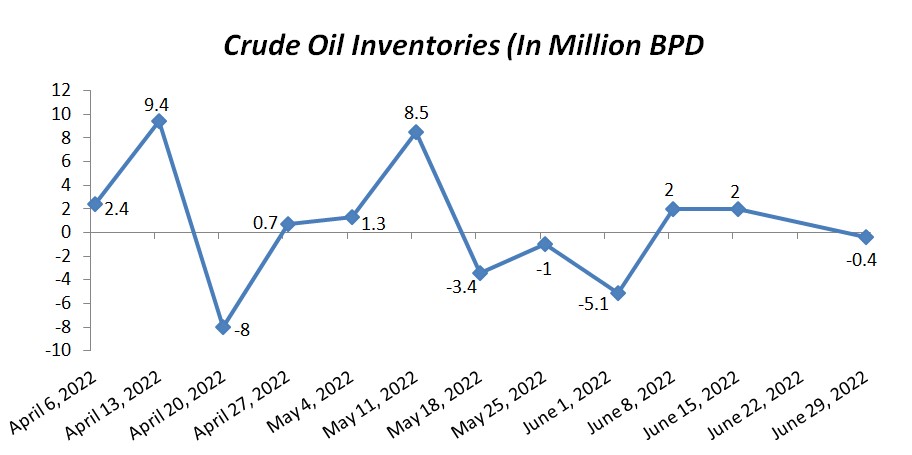

The above chart showcases that US Crude Oil inventories witnessed a slight decline in the last week, which is reported lower at (0.4) million per barrel. However, the prior week data showed positive inventory of 2 million per barrel, compared to the prior figure of (5.1) million per barrel on 01st June 22. Hence, based on the above inventory data and recent events from OPEC & Global uncertainty, the crude oil prices are expected to trade lower for the coming weeks.

Important Key Levels:

|

|

MCX CRUDE OIL (Rs.) |

WTI CRUDE OIL ($) |

|

Support 1 |

8200 |

102 |

|

Support 2 |

8000 |

95 |

|

Resistance 1 |

9000 |

105 |

|

Resistance 2 |

9350 |

108 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Commodities Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team