Difference Between Equity and Commodity Trading

5paisa Research Team

Last Updated: 30 Aug, 2023 12:36 PM IST

Content

- Introduction

- Equity Vs Commodity Trading - Key Differences

- Commodity Trading vs Equity Trading in India

- Equity vs Commodity - Which One To Choose

Introduction

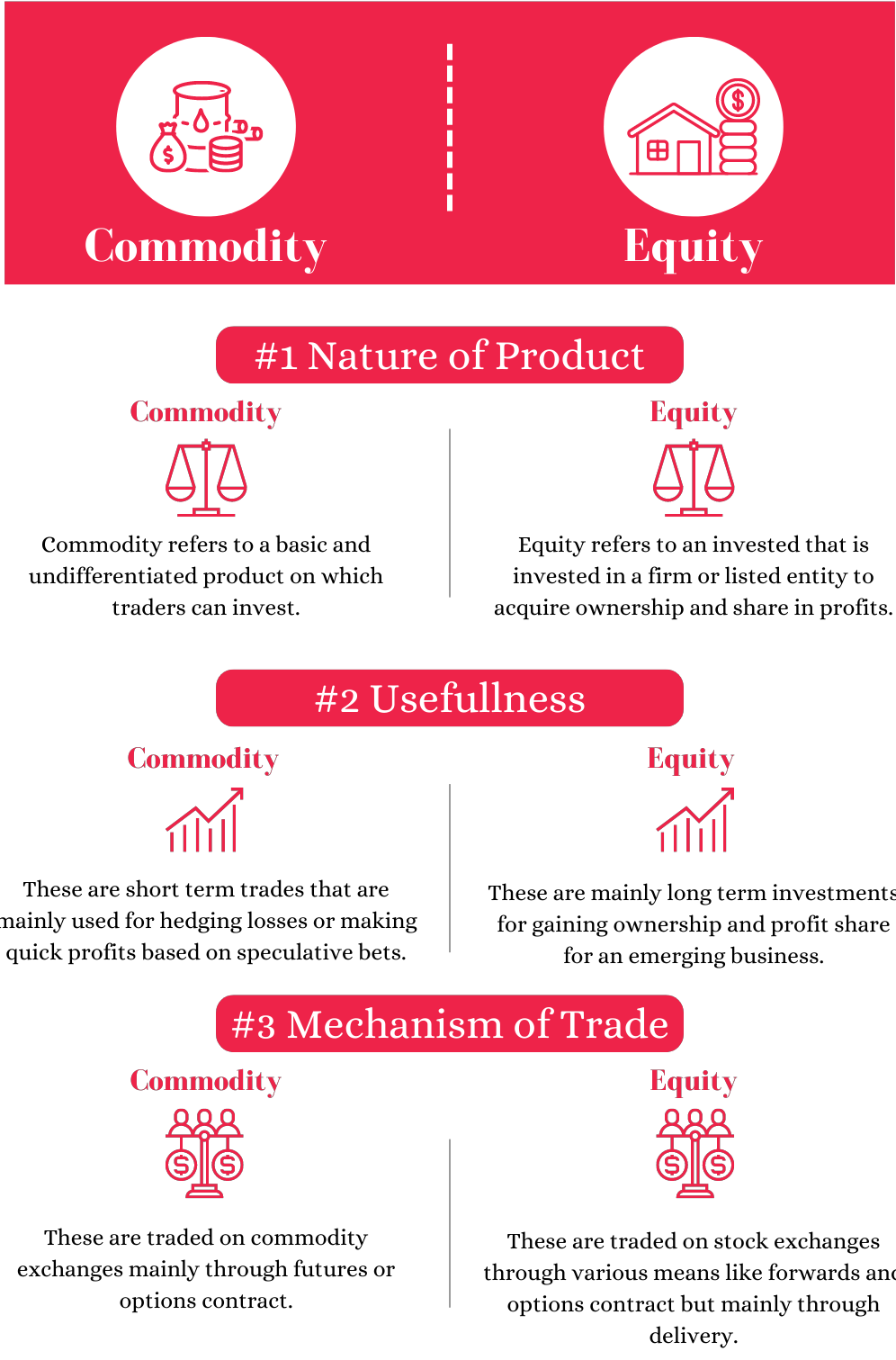

One of the primary difference between equities and commodity trading is that one is more hedging or underlying driven, whilst the other is more trade-driven. The stock vs commodity debate is mainly driven by the trader's intention. For hedgers, the equities vs. commodity dispute is more apparent than for traders. Looking at the structure of the two markets in India might help you comprehend the distinction between stock and commodities.

More About Commodity Trading Basics

- Major Commodity Exchanges in India

- Agriculture Commodities Trading

- Paper Gold

- Crude Oil Trading

- Commodity Index

- Gold Investment

- Commodity Market Timings

- What Is MCX?

- What is Commodity Trading?

- Types of Commodity Market

- Tips for Commodity Trading

- Tax on Commodity Trading

- The Role of Commodity Markets In India

- The Pros and Cons of Commodity Trading

- Important Things to Know Before You Start Trading in Commodity

- How to Trade in Commodity Options?

- How to Trade in Commodity Futures?

- How Commodity Market Works in India?

- How Can You Trade Commodity Online?

- Difference Between Equity and Commodity Trading

- Difference Between Commodity and Forex Trading

- What Is Commodity Market? Read More

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.