Types of Bonds

5paisa Research Team

Last Updated: 10 Apr, 2024 06:18 PM IST

Content

- What are the Types of Bonds?

- List of Different Types of Bonds

- Features of Bonds

- Advantages of Bonds

- Limitations of Bonds

- Things to Consider Before Investing in Bonds

- How to invest in bonds in India?

- Conclusion

Bonds are a popular form of investment because they offer regular income, capital preservation, and diversification benefits. It is a loan agreement between a borrower and a lender. When an entity or an individual buys a bond, they lend money to the issuer for a specific period.

The issuer promises to repay the amount at the end of the term with an agreed-upon interest rate. This article discusses different types of bonds in India, their features, advantages, limitations, and things to consider before investing.

More About Bond and Debenture

- PSU Bonds

- Floating Rate Bonds

- What is Clean Price and Dirty Price in Bonds?

- State Government Guarantee Bond

- Difference Between Zero Coupon Bonds and Deep Discount Bonds

- Foreign Currency Convertible Bonds (FCCB)

- Difference Between Bond and Debentures

- Masala Bonds

- Tax-Free Bonds

- Types of Bonds

- Government Bonds India

- What Is Coupon Bond?

- What is Bond Yield? Read More

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

Bonds are debt securities issued by governments, local authorities, companies, or other entities to raise capital. Investors buy bonds and receive periodic interest payments over a set period. After the investment period, the bond matures, and the borrower repays the principal.

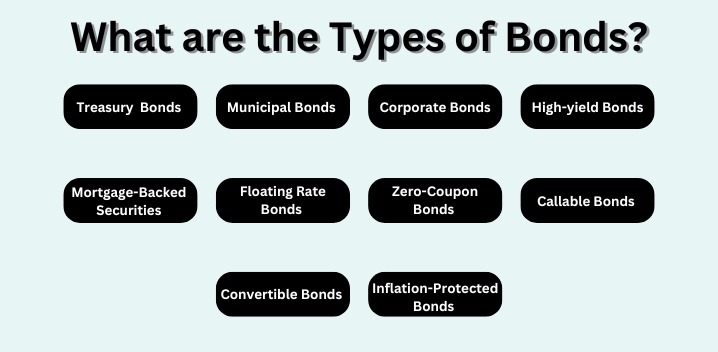

The most popular types of bonds include fixed-and floating-rate bonds, zero-coupon bonds, government securities bonds, and corporate and treasury bonds.

An example of a bond is a government bond, such as Treasury Bills and Government Bonds, with the Indian government's backing, complete faith, and credit.

There are several ways to buy bonds, including purchasing them through a broker or financial advisor, buying them directly from the issuer, or investing in bond mutual funds or exchange-traded funds (ETFs). Before buying bonds, you must research the issuer's creditworthiness and evaluate the bond's risk and return characteristics to make an informed investment decision.

Bonds are a safe investment because the issuer promise to repay the borrowed funds with interest. However, there are still risks associated with bonds, such as credit risk, interest rate risk, and inflation risk. It's important to evaluate these risks before investing in bonds.

The safest type of bonds is generally considered government bonds issued by stable and financially sound governments, backed by the government's ability to tax its citizens and print currency.

Bonds that mature within seven to ten years are intermediate-term bonds. These bonds balance shorter-term bonds with lower yields and longer-term bonds with higher yields but greater interest rate risk. They can be a suitable option for investors seeking a moderate level of risk and return.

A bond with a fixed interest rate, also known as a fixed-rate bond, means that the interest rate for the entire bond duration remains the same. This type of bond provides predictable cash flows for investors.

The repayment done by a traditional bond is also known as the principal, face value, or par value. It is the amount that the bond issuer agrees to pay the bondholder at maturity, in addition to any interest payments made over the bond's term.

Medium-term bonds typically have a maturity period of between two and ten years. It is suitable for investors seeking a balance between the steady income of short-term bonds and the potential for higher yields of long-term bonds.