Demat vs. Statement of Accounts: How Do You Store Your Mutual Funds?

Guidance on How Mutual Funds Work

Last Updated: 13th February 2024 - 04:19 pm

Mutual funds have been around for a long time now, but pop culture has brought them back into the limelight only recently. Fact is, in the year 2020, according to Statista, India had a mutual fund investment of about ₹12 trillion!

People have started to finally realize the true value of these long-term investments. Mutual funds come with many benefits and, like any coin, has two sides, certain risks as well. Let's take a quick look into how mutual funds work to understand their value and prospects for your future security.

What are Mutual Funds?

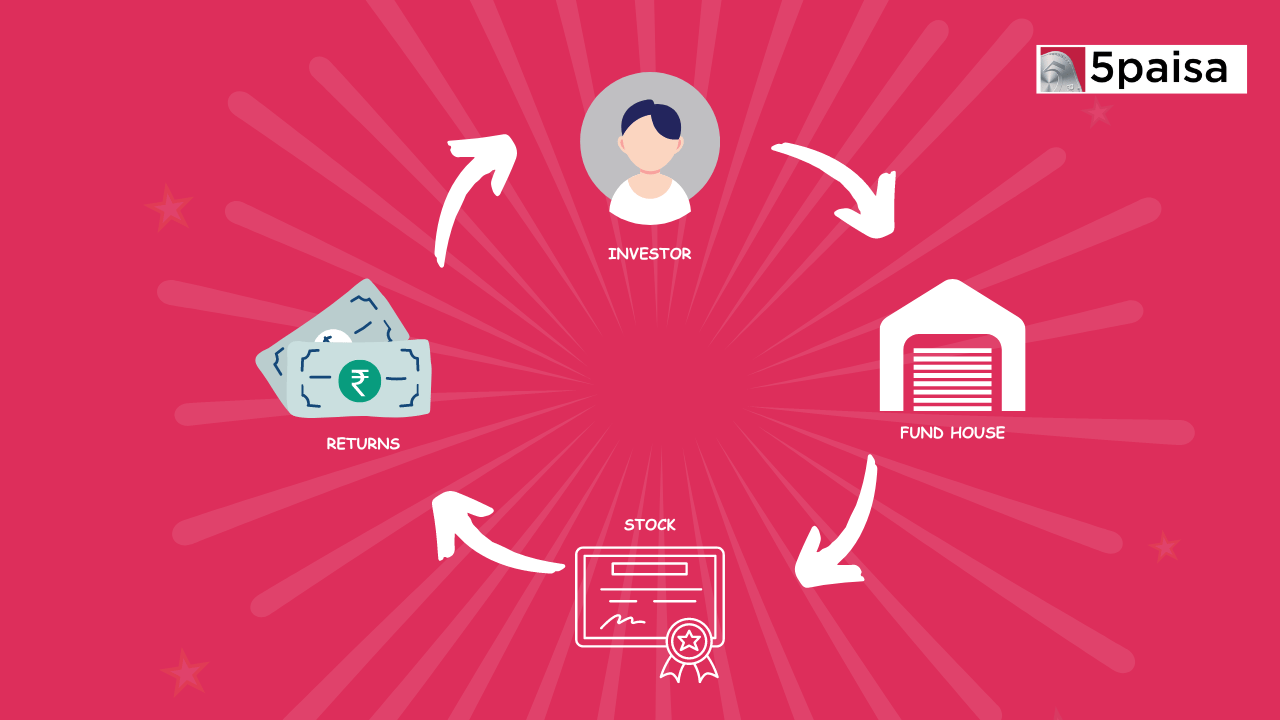

A mutual fund is made up of two words - "mutual" and "fund" - very aptly. It is basically a packet of funds collected from various willing investors, a kind of financial vehicle, which is further invested in securities in the market. A money manager (a professional in investment) is in charge of this packet of funds, and he rotates these funds in the market with a view to gain some profits from it for the investors.

How your mutual fund goes around depends on the rules and conditions you define for it in the prospectus that stays updated with your money manager. Mutual funds give small investors a chance to be a (proportionate) part of a larger fund portfolio which is professionally handled by money managers. Since there are a variety of securities in which this fund is invested, the gains from each mutual fund are determined based on its category (whether small-cap, medium-cap, large-cap, Flexi-cap, etc.).

Mutual Funds' Concept Explained

Mutual funds can be thought of as a mechanism to pool funds from different investors (like you or your friend) and invest this collection into securities, such as stocks and bonds. Since this money is invested in the market, it is subject to respective ups and downs that the daily Sensex brings. You can track the performance of your portion in the mutual fund by tracking the performance of the stock/bond/share/etc. that it was invested in.

The point to note is that there is an innate difference between investing in a mutual fund and investing directly in shares or stocks. When you put your money on a mutual fund, you get access to a portion of the performance that it marks in the market - this could potentially come from ten different securities owned by different entities.

On the other hand, investing directly in a share keeps you invested in the company it belongs to and may give you voting rights depending on the quantum. Buying mutual funds doesn't get you voting rights, because it consists of various market securities.

On the same note, while shares and stock prices are direct indicators of their value, the same doesn't apply to mutual funds - because it is comprised of many different stocks and shares of different values. Instead, the Net Asset Value is used to indicate how well or poorly a mutual fund is doing in the market.

The NAV of a mutual fund can be determined by dividing the total number of securities in that portfolio by the total number of outstanding shares. The interesting thing is, unlike the volatile nature of market shares, the NAV of mutual funds doesn't update every hour. It is updated every day at the end of the trading day.

Let's now understand how mutual funds work.

How do Mutual Funds Work?

Think of mutual funds as a company that deals with investments. When you buy a share in this mutual funds company, you gain a portion of its profits that are proportional to your investment in the company. Now, there are three major ways that you can access these profits, based on your requirement or preferences:

a) By way of income. You can define your prospectus to generate regular income for you from the dividends that your share in a mutual fund is earning. Either this, or you can have it reinvested in the market for more shares.

b) By way of capital gains. A mutual fund encashes capital gains when it sells securities that have increased in price. These gains are then passed to the investors by way of distribution.

c) By way of selling your mutual funds share. If the mutual fund that you invested in has increased in price but the fund's manager hasn't sold them yet, you can sell your portion of the fund to cash in on some profit.

Mutual funds, since they can be treated as long-term investments, tend to absorb the ups and downs of the market. This is why people today prefer these financial vehicles as a mode of dynamic savings that grow steadily over time.

Conclusion

Mutual funds aren't difficult to understand. A majority of their handling is done by funds managers, so if you do plan to invest in a mutual fund, you barely need to do anything yourself except for determining the terms for investing your money.

Trending on 5paisa

Discover more of what matters to you.

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Aticles to read next

10 Best SIP Plans for 10 years in India to Invest in 2023

10 Best SIP Plans for 3 years in India to Invest in 2023

Recent Articles

Market Outlook for 21st November 2024

November 21, 2024Positron Energy IPO Allotment Status

August 21, 2024Saraswati Saree Depot Ltd IPO Allotment Status

August 20, 2024 5paisa Research Team

5paisa Research Team Tanushree Jaiswal

Tanushree Jaiswal