Market Outlook for 06th December 2024

Nifty Outlook - 30 August 2022

Last Updated: 10th December 2022 - 08:16 pm

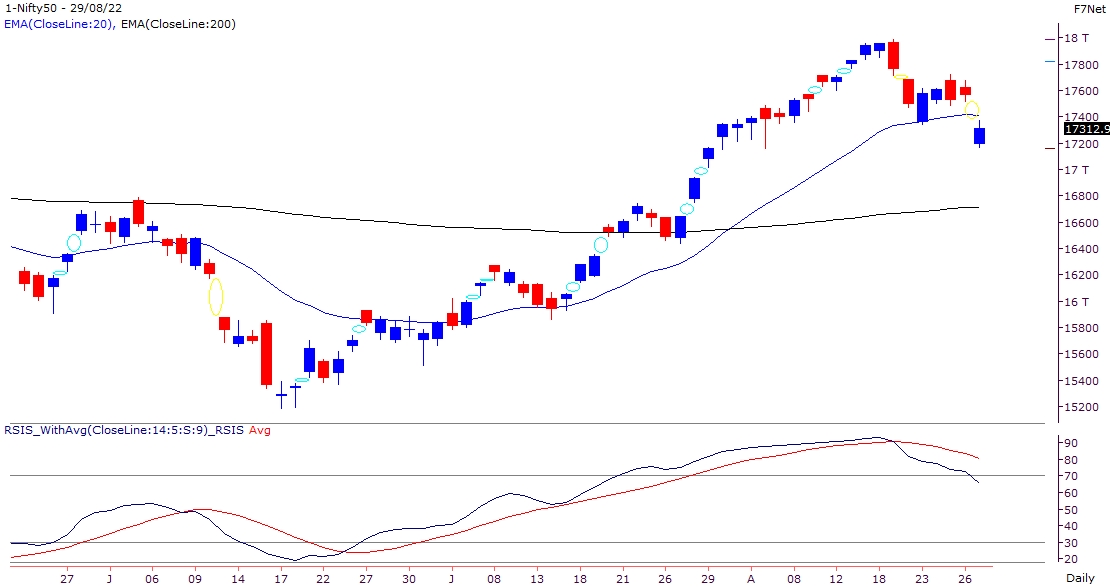

The U.S. markets corrected sharply in Friday’s session following the Federal Reserve Chair Jerome Powell’s warning that the central bank will not end its fight against inflation anytime soon. In line with the same, our markets started the week with a huge gap down below 17200. The index however, recovered some of the losses during the day and ended above 17300 with a loss of almost one and a half percent.

Nifty Today:

Nifty breached the recent swing low support and the important support of ’20-day EMA’ with a gap down opening. This also confirms the ‘Lower Top Lower Bottom’ structure on the daily chart and as we anticipated last week, the market has resumed its corrective phase. The momentum readings on the daily as the hourly chart continue to indicate negative momentum. The immediate support for Nifty is now placed around 17100 which would be the important level to watch in the near term. On the flipside, 17450 and 17530 are likely to act as resistance on any pullback move. In Monday’ session, the broader markets witnessed positive traction after the gap down as the midcap index recovered well. The Midcap100 index is still above the support of 30100 which is the sacrosanct.

Market corrects after hawkish Fed comments

Till the index trades above this, stock specific action could continue within this basket. However, once the index breaks the mentioned support then we could see price wise correction in midcaps as well. Traders are advised to look for stock specific trading opportunities for now with a sell on rise view on the index. Any pullback moves towards the above mentioned resistances in Nifty could be opportunities to look for selling opportunities.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

17165 |

38650 |

|

Support 2 |

17090 |

38770 |

|

Resistance 1 |

17450 |

37900 |

|

Resistance 2 |

17530 |

37670 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team