Demat vs. Statement of Accounts: How Do You Store Your Mutual Funds?

Asset allocation using mutual funds

Last Updated: 12th December 2022 - 12:06 pm

Asset allocation is an integral part of initiating and balancing an investment portfolio and is one of the most crucial factors that drive the overall return. The impact of allocating assets is even more than picking the right individual stocks. Building the appropriate asset structure for equities, fixed income, cash and real estate in your portfolio is a dynamic process. Therefore, your asset allocation should always reflect your goals.

What is asset allocation?

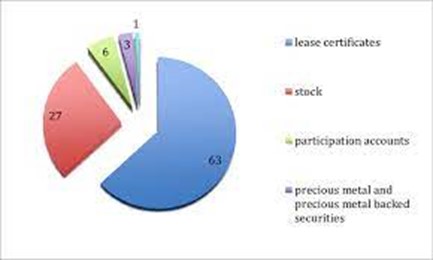

Asset allocation is a strategy used in investments aimed at balancing risk and rewarding by bifurcating the investment portfolio into various types of asset classes such as cash and cash equivalents, equities, fixed income, and real estate. In theory, asset allocation helps investors reduce the impact of risk on their portfolio, as each class has a diversified correlation with the other assets.

Significance of asset allocation using mutual funds

Different asset classes move and reciprocate in different directions. All types of asset classes rarely evolve together. Some may think that investing in a very strong investment trust at a particular point in time is the best way to time the market. However, it is very difficult for an individual to predict in which direction an asset class will move at a particular point in time.

For example, when share prices go up, investment in Gold or Bank savings accounts can go down and vice versa.

Therefore, it makes sense to allocate investment to a combination of asset classes. This is done so that if the performance of one group of asset classes or funds deteriorates, the other asset classes compensate for the performance degradation. Investing a portfolio in one asset class or trust can be very risky. However, investors tend to generate better returns when their wealth is diversified across asset classes.

Factors that may affect asset allocation

The process of determining the right asset combination for your portfolio is very personal. When making an investment decision, an investor's asset allocation decision is influenced by a variety of factors, like:

1. Term of investment

A term is a period that an investor expects to invest in achieving a particular goal. Different investment periods have different desires for risk. For example, long-term investment periods can encourage investors to invest in higher-risk portfolios, as slow business cycles and high market volatility tend to be overcome over time.

2. Risk tolerance

As an investor, this is all about your ability and willingness to lose some or a part of your original investment in the expectation of better benefits. Aggressive investors may have a high-risk appetite in anticipation of potential returns, on the other hand, risk-aversive investors may choose to invest in securities that may generate moderate returns but at a lower risk.

3. Risk vs Return

It is all about no pain, no gain. Investments carry risk – The higher the risk, the better can be your returns. Risk and return are inextricably linked. The reward for taking risks means that you are more likely to get a better return.

The asset allocation mechanism

Let's take an example

Mr XYZ has a store that sells summer clothing such as skirts, t-shirts, cotton suits, etc. Thus, the store does an important business during the summer season. However, stores tend to close in the winter. Now, the store has decided to expand its reach.

They set up a department to sell all kinds of clothes that can be worn even in the colder months. They are also starting to sell other accessories such as belts, handbags, accessories, shoes, etc. Today, the store is creating business in all seasons. In addition, the store has decided to open several departments to sell books, furniture, groceries, electronics, and more.

What used to be a tiny little window store today has grown into a huge department store that does great business all year round. The departmental stores sell all kinds of merchandise all year round, so the risk of rain or shine is much less.

Asset allocation works in a similar concept, using the diversification of investments across asset classes to minimize risk.

Here are the strategies for asset allocation using mutual funds

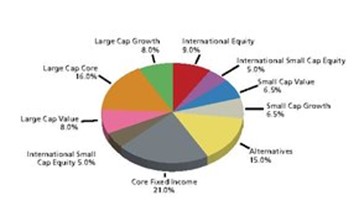

1. Strategic asset allocation

This method caters to a basic policy mix based on the expected return of each asset class. Under this strategy, you must consider the duration and risk tolerance of the investment. You can set goals and then balance your portfolio. Strategic asset allocation is similar to buy-and-hold strategies, suggesting strong diversification to mitigate risk and increase returns.

For example, if stocks have returned 15% annually and bonds have returned 10% annually, combining 50% equity and 50% bonds is expected to generate 12.5% annual earnings.

2. Tactical asset allocation

You may occasionally need to make short-term, tactical deviations from the mix to take advantage of exceptional investment opportunities. This plasticity adds a market-timing component to the portfolio, allowing one asset class to participate in a more favorable economic situation than another. Tactical asset allocation can be characterized as a reasonably active strategy, as the overall strategic asset composition recovers when the desired short-term profits are achieved.

This strategy requires some discipline as it must first identify the expiration of short-term opportunities and then rebalance the portfolio towards long-term asset positions. The combination of assets in the portfolio should always reflect the goal.

3. Constant-weighting asset allocation

This approach allows you to continuously balance your portfolio. For example, if the value of an asset goes down, you will buy more of that asset. And when that asset grows, you will sell it. There are no strict rules for rebalancing a portfolio as part of a strategic or constant weight asset allocation. However, as a general rule of thumb, if a particular asset class deviates by more than 5% from its original value, the portfolio should be readjusted to its original composition.

4. Dynamic asset allocation

This strategy constantly adjusts the asset mix as the market rises and falls, and the economy recovers or weakens. This strategy sells declining assets and buys increasing assets. Dynamic asset allocation relies on the portfolio manager's judgment, not the asset target mix. This makes dynamic asset allocation the exact opposite of certain weighted strategies. For example, if the stock market is sluggish, sell stocks in anticipation of a further decline, and if the market is strong, buy stocks in anticipation of a further rise in the market.

5. Insured asset allocation

An insured asset allocation strategy sets a basic portfolio value that the portfolio should not go down. As long as your portfolio produces returns that exceed that threshold, you engage in judgment, active management, forecasting, analytical research, and which securities to buy, hold, or sell to increase the value of your portfolio. If the portfolio is an underlying asset, invest in risk-free assets such as the Ministry of Finance to maintain the underlying asset.

At this point, consult your advisor to rebalance your assets and, in some cases, completely change your investment strategy. Insured asset allocation may be suitable for risk-averse investors who want some active portfolio management but appreciate the peace of mind of guaranteed floors where the portfolio cannot go down.

6. Integrated asset allocation

Integrated asset allocation considers both returns and risks when creating an asset structure. All of the above strategies consider future market returns, but not all investors' risk needs. This is where integrated asset allocation works. This strategy incorporates all aspects of the past, not only expectations but also modifications in capital markets and willingness to risk.

Integrated asset allocation is a more comprehensive asset allocation strategy. However, investors do not want to implement two strategies that compete with each other, so they cannot include both dynamic and constant weight assignments.

Conclusion

Asset allocation can be active or purely passive to varying degrees. Asset allocation depends on the investor's goals, market expectations, returns, age, and risk aspirations. You can use asset allocation as part of your core strategy in responding to market movements that require a high degree of expertise to use specific tools to time those movements. Make sure your strategy is less prone to unpredictable errors, as the perfect timing of the market is almost impossible.

When it comes to asset allocation, the concept of "one size for everything" doesn't apply. Economic conditions vary from person to person and require a unique and different approach. Investors need to review their financial strategies regularly to ensure they are consistent with their financial goals, risk profile, and investment duration. If you don't know the best asset allocation to reach your goals, you need to look for professional services. Happy investing!

Key takeaways

1) Asset allocation is integral for balancing an investment portfolio.

2) Asset allocation strategies use an asset structure considering their goals, risk appetite, returns expectation, and tenure of investment.

3) Strategic asset allocation is all about setting goals, creating and rebalancing your investment structure.

Also Read:-

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team