L&T Eyes $50-$60 Billion Projects by FY25, Plans Major O2C Investments

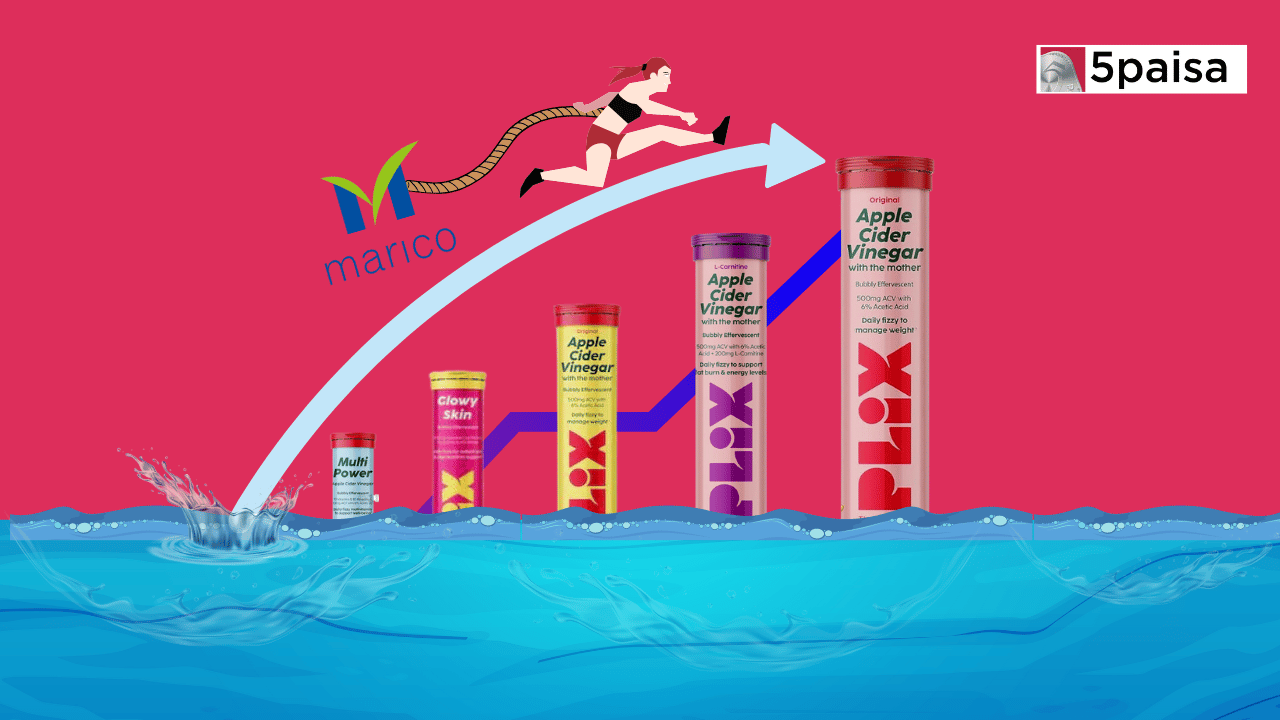

Marico Shares surge after acquiring 58% stake in Satiya Nutraceuticals

Last Updated: 27th July 2023 - 04:58 pm

In a bold and strategic move to bolster its position in the ever-growing health and wellness sector, Marico Ltd. has successfully completed the acquisition of a controlling 58% stake in Satiya Nutraceuticals Pvt, a rising star in the plant-based health products industry.

The acquisition, valued at a staggering ₹369 crore, paves the way for Marico to harness the immense potential of health-conscious consumers and capitalize on the rapid expansion of the market for health-centric products.

The acquisition process unfolded in two stages, with Marico initially acquiring 32.75% stake in Satiya Nutraceuticals. The remaining 25.25% stake is slated for purchase by May 2025, granting Marico significant majority control over the board.

Marico has secured an option to acquire the remaining 42% stake after three years from the execution date, subject to necessary approvals. The final consideration for this additional stake will be determined at that opportune moment.

Satiya Nutraceuticals has gained immense popularity with its flagship brand, 'The Plant Fix-Plix,' which has captured the hearts of health-conscious consumers seeking plant-based alternatives.

Their impressive range of products includes protein powders, collagen boosters, anti-aging solutions, peanut butter, apple cider vinegar, and an assortment of nutritious snackable foods. Operating primarily through e-commerce and a robust direct-to-consumer (D2C) channel, the company has effectively tapped into the digital sphere to connect with its customers.

The joint statement released by Marico Ltd. and Satiya Nutraceuticals Pvt. Ltd. highlights their ambitious plans to expand the brand's presence beyond the digital landscape into brick-and-mortar stores, marking a strategic shift that promises to bolster the brand's outreach to a wider audience.

Satiya Nutraceuticals has experienced a remarkable surge in revenue, soaring from ₹41.6 crore in the previous fiscal year to a staggering ₹06.43 crore in FY23. These impressive numbers underscore the remarkable market demand for their array of plant-based offerings. Notably, as of March 2021, the company's turnover was reported at ₹11 crore, showcasing its meteoric rise in a relatively short period.

Market experts and investment firm Morgan Stanley have expressed unwavering confidence in Marico Ltd.'s stock, awarding it an overweight rating with an impressive target price of ₹611. Morgan Stanley highlights that the acquisition of 'The Plant Fix-Plix' brand will be a pivotal driver in enabling Marico to achieve its ambitious revenue target of ₹400 crore in FY24.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

05

Tanushree Jaiswal

Tanushree Jaiswal

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team