Demat vs. Statement of Accounts: How Do You Store Your Mutual Funds?

Top 5 performing Mutual Funds

Last Updated: 13th December 2022 - 06:40 pm

Mutual funds have been around since the 1960s, and in the past decade, India's mutual fund industry has grown exponentially. With changes to India's financial rules, investing in mutual funds has become more critical than ever. One thing that attracts a lot of investors is that you can make money not just from growth but also from dividends.

High returns with low volatility. These are the goals of every mutual fund investor. There are several benefits of investing your money in mutual funds over other options, such as insurance and real estate. Mutual funds allow you to diversify your portfolio and invest in multiple companies at once.

What are top-performing mutual funds?

Mutual funds are a type of investment scheme which pools money from different investors to invest in a range of securities like stocks, bonds, money market instruments, etc. It is managed by professional fund managers who buy and sell securities based on their knowledge and experience about the market condition. The fund managers invest the pooled money in different types of securities depending on the fund's investment objective.

Each mutual fund has an investment objective. They specify what kind of returns they will offer, what type of risk they will incur and their asset allocation strategy, among other factors. For example, a debt fund will invest in debt instruments like bonds and corporate debentures. In contrast, a large-cap equity fund will invest predominantly in shares of companies with a high capital value. Thus, every mutual fund is different in investment objectives and asset allocation.

Various Asset Management Companies (AMCs) offer many schemes to invest in. While some plans offer to provide high returns with high risk, others might have lower risks but also lower returns as well. Thus, selecting the right kind of mutual funds is essential to growing your money consistently over time.

Top performing mutual funds consistently meet or exceed their stated performance goals. Top performing mutual funds are commonly called star performers. Many funds have a benchmark index that they aim to outperform. A top-performing mutual fund will beat its benchmark with greater returns.

These funds can be classified based on their performance over different periods. The best of them are the ones that have outperformed their peers consistently over a long period.

Which are the five top-performing mutual funds?

1) Axis Blue-Chip fund-Growth (NAV: Rs.44.9800)*

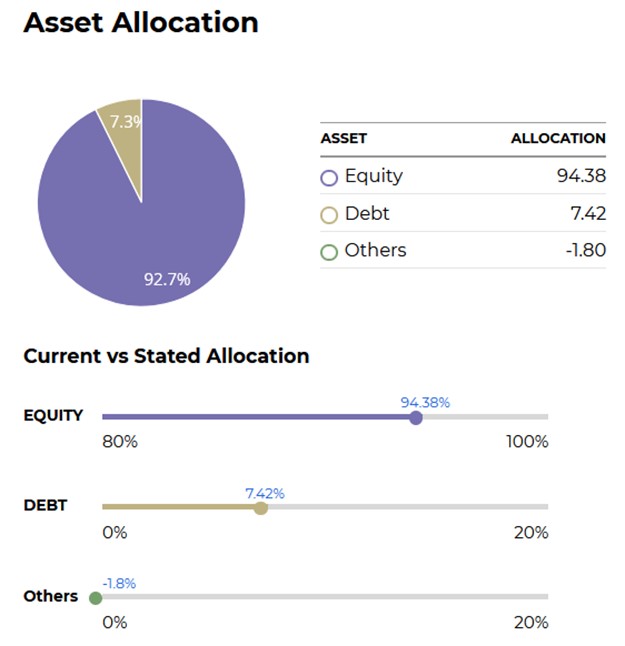

Source: Axis Bluechip Fund (Growth)

Axis Bluechip Fund is suitable for those looking for Long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity-related instruments of large-cap companies.

The scheme is for all investors who wish to invest in a fund that seeks to provide long-term capital growth through investments made primarily in large-cap companies & can participate in the development of the economy as a whole.

It is also suitable for investors who are seeking:

i) Investment predominantly in large-cap companies' equity and equity-related securities.

ii) Long-term capital appreciation

iii) Diversification across sectors

2) SBI Small Cap Fund-Growth (NAV: Rs. 101.4824)*

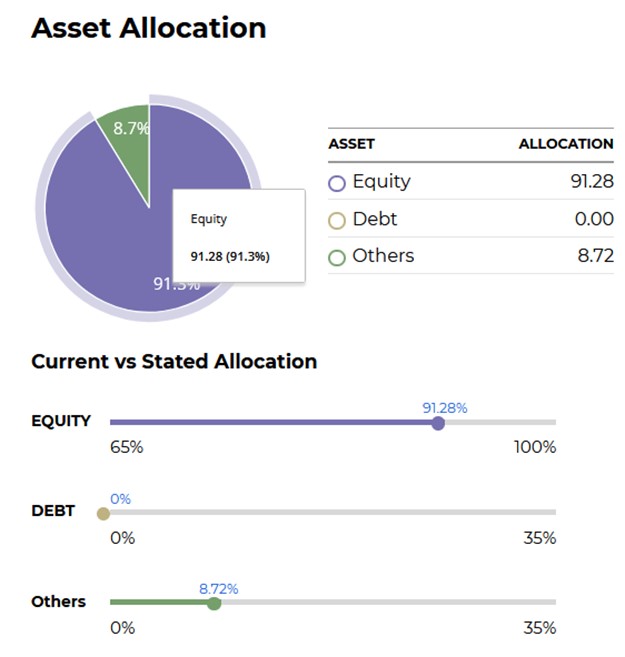

Source: SBI Small Cap Fund (Growth)

The scheme's investment objective is to provide investors with opportunities for long-term growth in capital and the liquidity of an open-ended scheme by investing predominantly in a well-diversified basket of equity stocks of small-cap companies.

1) The scheme predominantly invests in equity stocks of small-cap companies and is risky and volatile.

2) The scheme also provides the flexibility to invest in other equities (including large and mid-cap companies), debt and money market instruments, according to SBI Mutual Fund.

3) The portfolio construction is based on a bottom-up investment style with a blend of growth and value approach for stock selection, it adds.

3) Aditya Birla Sun Life Digital India Fund -Growth (NAV: Rs. 133.3600)*

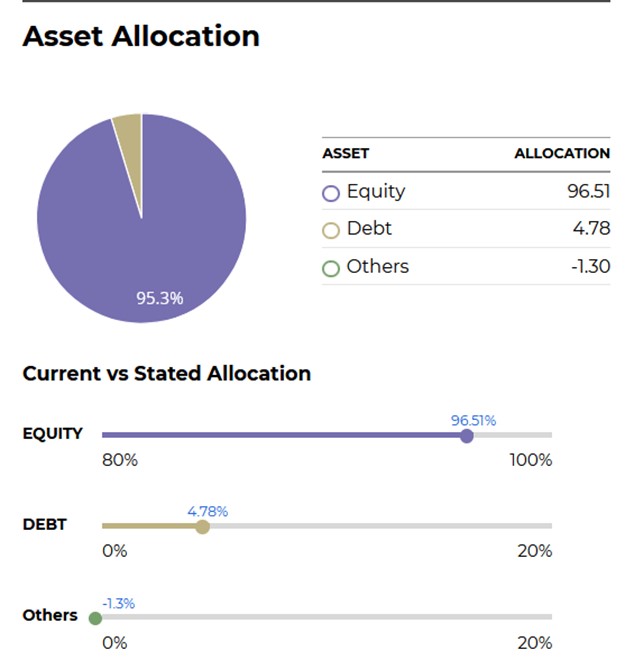

Source: Aditya Birla Sun Life Digital India Fund (Growth)

Aditya Birla Sun Life Digital India Fund seeks to generate long term capital appreciation and provide secondary income generation focusing on technology and technology-dependent companies.

The investment strategy adopted by Aditya Birla Sun Life Digital India Fund is that it invests in companies engaged in providing products or services to aid in the development of Digital India or companies that will benefit from Digital India initiatives. It follows a blend of value and growth style with a bottom-up approach to stock picking.

It includes a portfolio of Equity and Equity related securities of companies that are engaged in the businesses of Digital/Internet, Artificial Intelligence, Internet of Things, Big Data Analytics, Robotics, Blockchain Technology and Virtual Reality. The scheme will also invest in other companies' Equity and Equity related securities that may benefit from digitisation.

4) Tata Digital India Fund-Growth (NAV: Rs. 36.7439)*

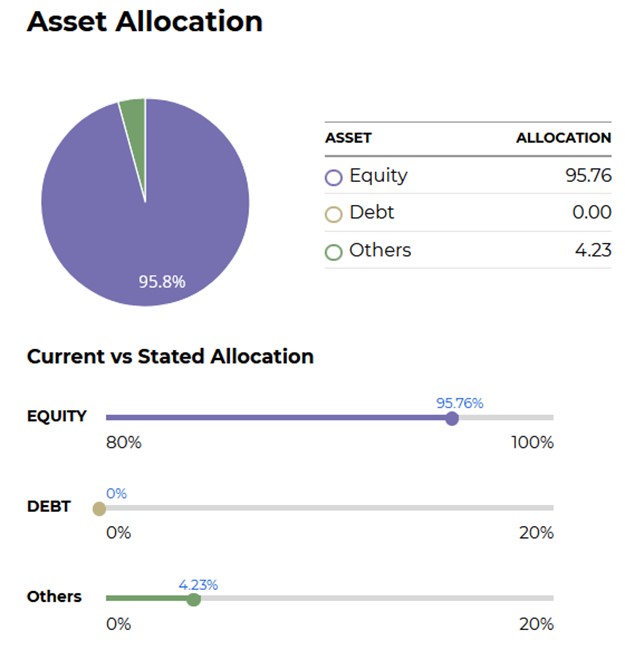

Source: Tata Digital India Fund (Growth)

The scheme seeks long term capital appreciation by investing at least 80% of its net assets in equity/equity-related instruments of the companies in the Information Technology Sector in India.

Investment Strategy:

1) The scheme will primarily invest in equity and equity-related instruments of companies (including derivatives on the index) that are part of the Information Technology Sector Index.

2) It may also invest in other sectors and segments to the extent permitted under normal circumstances.

3) The returns from the fund have been consistent across various periods and relatively lower volatility than its benchmark, which suggests that the fund's risk-adjusted return profile is superior to its peers.

5) Canara Robeco Hybrid Fund-Growth (NAV: Rs. 245.1300)*

Source: Canara Robeco Hybrid Fund (Growth)

The fund seeks to build a balanced portfolio, which would provide a combination of high annual returns and capital appreciation.

It is an open-ended Aggressive Hybrid scheme that invests in balanced equity, debt and money market instruments. The fund seeks to provide capital appreciation and income distribution to investors by investing in equity and equity-related securities of large-cap companies.

The fund has a diversified portfolio with equity, mid-cap, small-cap, large-cap, and debt securities. This fund is ideal for medium risk investors who want to invest for over three years. Investors should understand that the scheme involves market risks, and there is no guarantee for any returns on investment.

(*NAV is as of 15-Feb-2022)

Here is an overview of the top-performing mutual funds:

|

Scheme Name |

Launch Date |

AUM (as of January 31, 2022) |

Expense Ratio |

Benchmark |

Minimum Investment |

Exit Load |

Annual Return (3Yrs) |

|

January 5, 2010 |

Rs.34181.9 crore |

1.69% |

S&P BSE 100 Total Return Index |

Rs.5000 |

1% (if redemption is within 1 year) |

18.76% |

|

|

September 9, 2009 |

Rs.11,288.35 crore |

1.73% |

S&P BSE 250 SmallCap Total Return Index |

Rs.5000 |

1% (if redemption is within 1 year) |

29.59% |

|

|

January 15, 2000 |

Rs.3085.94 crore |

2.13% |

S&P BSE Teck Total Return Index |

Rs.1000 |

1% (if redemption is within 30 days) |

36.52% |

|

|

December 28, 2015 |

Rs.5039.4 crore |

1.97% |

S&P BSE IT Index |

Rs.5000 |

0.25% (if redemption is within 30 days) |

34.5% |

|

|

July 20, 2007 |

Rs.7406.91 crore |

1.92% |

CRISIL Hybrid 35+65 Aggressive Index |

Rs.5000 |

1% (if redemption is within 1 year) |

18.08% |

How to select the top-performing mutual funds?

Here are some tips for choosing the best performing mutual funds:

Investment objective: Choose a suitable mutual fund scheme according to your investment objective. If the aim is to long-term wealth creation, invest in equity diversified large-cap schemes. If you want stable returns with low risk, invest in debt funds.

Look at performance: Check the historical returns of the mutual fund scheme over short-term (1-3 years), medium-term (3-5 years) and long term (more than five years). Select the top-performing funds based on their track performance record across various market cycles.

Diversification: Invest in diversified equity funds that offer exposure to large, mid, and small-cap stocks. Diversification across sectors and market capitalisation reduces risks.

The past performance of a mutual fund scheme is the most important parameter used in selecting a mutual fund scheme. But it is equally important to understand that past performance does not guarantee future returns. Yet, it is an important indicator. It helps in knowing the risk-return profile of any mutual fund scheme and its performance compared to its benchmark and peers.

The top-performing mutual funds are identified by comparing their returns with other schemes from the same category over the past few years. The upper quartile performing plans are considered top-performing funds.

Disclaimer: The investment returns from the scheme may vary depending upon the scheme's performance. The schemes may not be suitable for all investors. Investors must read the Scheme Information Document (SID) before investing. Investors should consult their financial advisor if they doubt whether the product is suitable for them.

So that was our take on the top five mutual funds, performance-wise. Hope you found it helpful.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta