List Of Maharatna Companies In India

Stock of the day: Bajaj Auto

Last Updated: 29th November 2023 - 11:20 am

In the dynamic landscape of the stock market, certain companies stand out with remarkable performances, and Bajaj Auto is undeniably one such entity. Renowned for motorcycles like Dominar, Pulsar, and Avenger, Bajaj Auto has witnessed an extraordinary surge, delivering over 65% returns to investors year-to-date.

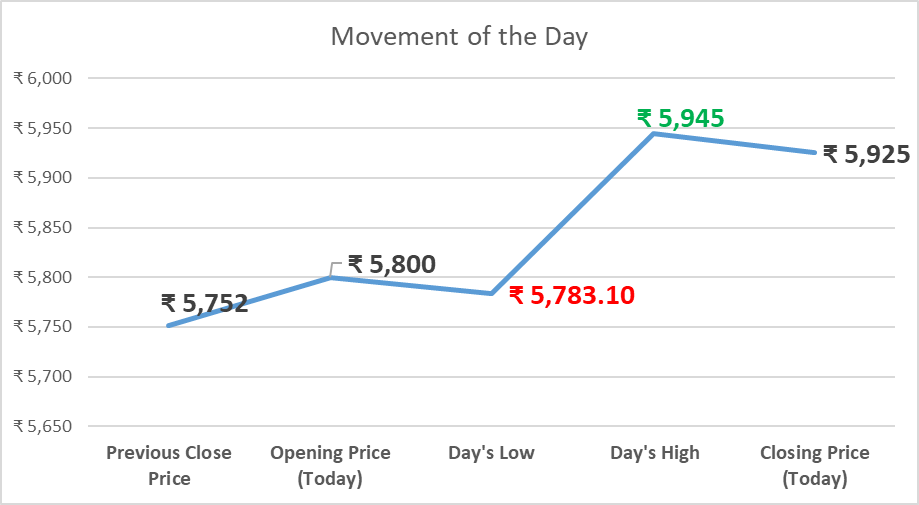

As of Thursday's trading session on November 23, the stock reached an all-time high of Rs 5,939.05 per share, marking an impressive journey that demands a closer look.

About:

The main business of the Bajaj Group, Bajaj Auto, manufactures two- and three-wheelers and exports them to 79 nations, including several in Southeast Asia, Latin America, and Africa. India's Pune serves as its headquarters.

When the firm originally purchased KTM in 2007, it only owned 14% of the sports and super sports two-wheeler brand. Now, it owns 48% of KTM.

Key Drivers of Bajaj Auto's Soaring Stock:

1- Strong Q2 Results:

1. Bajaj Auto's stellar performance in the July-September period, reporting a standalone net profit of Rs 1,836.1 crore, marked a 20% YoY increase.

2. The boost was attributed to robust sales of margin-boosting three-wheelers and premium motorcycles.

3. With a 5.6% growth in revenue from operations to Rs 10,777.3 crore, the Q2 results exceeded analysts' expectations.

2- Brokerages' Bullish Views:

1. Prominent financial institutions have maintained 'overweight' ratings on Bajaj Auto, reflecting their confidence in the company's growth.

2. Raised target prices, indicate a positive outlook and solidify investor trust.

3- Festive-Season Boost:

1. The festive season witnessed a significant uptick in sales, particularly for 125 CC+ bikes, registering a 50% YoY growth.

2. Bajaj Auto's overall growth increased by 20% YoY, signaling a promising recovery in exports during this period.

4- Retained Market Share in Three-Wheeler Segment:

Bajaj Auto continues to dominate the three-wheeler segment, retaining a market share of over 80%. This resilience is a testament to the company's strategic positioning and product competitiveness.

5- Vehicle Sales and Launches:

1. Triumph Motorcycles sales exceeded expectations, and Bajaj Auto is prioritizing production and distribution, targeting up to 10,000 units per month.

2. Analysts anticipate a robust ramp-up for the Chetak EV and the launch of a new model next month.

3. With successful models like the Pulsar N150 and plans for six new launches in the next six months, Bajaj Auto is poised for further market share gains.

Financial Summary

| Stock P/E | 24.5 |

| Book Value | ₹ 1,037 |

| Dividend Yield | 2.36 % |

| ROCE | 26.2 % |

| ROE | 20.2 % |

| Face Value | ₹ 10.0 |

| Debt to equity | 0 |

| Return on assets | 17.0 % |

| PEG Ratio | 3.43 |

| Int Coverage | 208 |

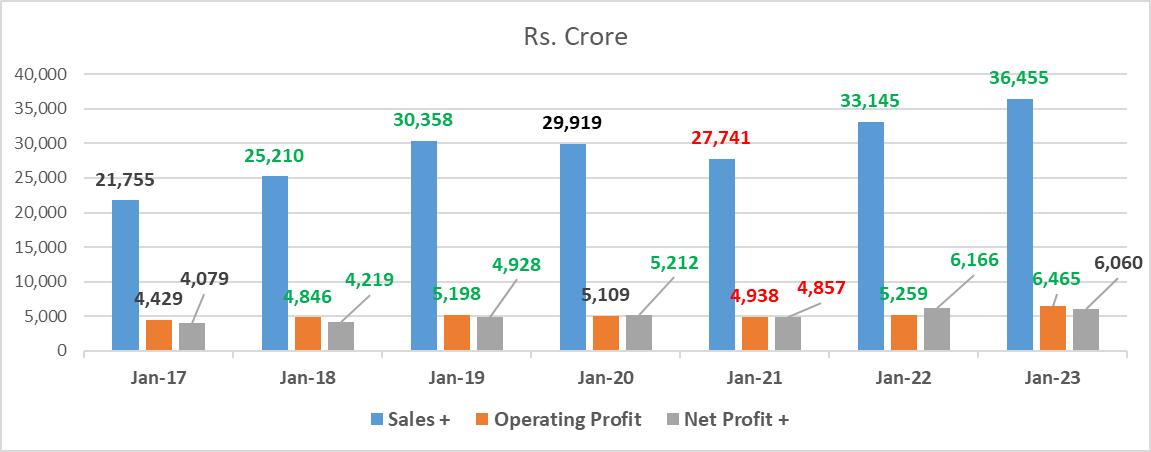

Financial Performance of Bajaj Auto So far:

Analysis:

1- Compounded Sales Growth: TTM: 12%

2- Compounded Profit Growth: TTM: 22%

3- Return on Equity 10 Years: 23%

Strength of the Company:

1- The company has nearly no debt.

2- The business has been paying out a strong 71.5% dividend.

3- The number of debtor days decreased from 23.3 to 17.6 days.

In retrospect, Bajaj Auto's stock has been on an impressive trajectory, rewarding investors with consistent growth. The amalgamation of strong financial results, favourable views from leading brokerages, festive-season momentum, market share retention, and strategic vehicle sales and launches has propelled the stock to new heights.

As Bajaj Auto navigates the complexities of the automotive industry, the company's proactive measures and positive market sentiment are key indicators of a promising future. Investors and enthusiasts alike will be keenly observing the company's strategic moves and anticipating continued success in the evolving landscape of the Indian automotive market.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta