Stock in action – NTPC Green Energy 05 December 2024

Stock in Action – Rain Industries Ltd.

Last Updated: 16th February 2024 - 05:48 pm

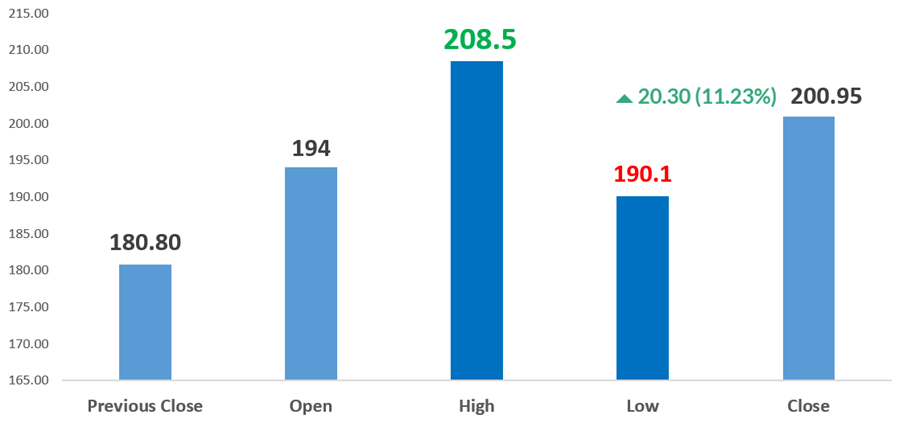

Rain Industries Stock Movement of Day

Rain Industries Intraday Analysis

- Stock shows bullish momentum as indicated by VWAP above previous close & rising moving averages.

- High trading volume suggests strong investor interest. However, resistance at R1 pivot level & near 52-week high could lead to short-term consolidation.

- Beta of 1.28 suggests higher volatility.

- Stock's all-time high & low demonstrate significant price fluctuations historically.

- Support levels at S1 - 178.40 & S2 - 176 pivot points provide downside protection.

- Overall, technical indicators suggest potential continuation of upward trend with caution around resistance levels.

Probable Rationale Behind Stock Surge

Rain Industries Limited (NSE:RAIN) has witnessed significant surge in its share price, gaining 27% over last month. This remarkable performance has also translated into respectable full-year gain of 15%. Several factors could potentially explain surge in company's stock price, as outlined below:

1. Price/Sales Ratio Analysis

Rain Industries' price-to-sales (P/S) ratio of 0.3x appears relatively low compared to other companies in Indian Chemicals industry, where P/S ratios above 1.5x are common.

Low P/S ratio may signal potential undervaluation, attracting investors seeking stocks with favorable valuation metrics.

2. Revenue Growth Metrics

Rain Industries has demonstrated robust revenue growth over past three years, with commendable 83% overall rise despite recent short-term performance challenges.

Despite sluggish revenue growth in past year, company's medium-term annualized revenue results outpace industry expectations, indicating strong momentum.

Discrepancy between Rain Industries' revenue growth & its comparatively low P/S ratio suggests that investors may have discounted future revenue potential, possibly due to perceived risks.

3. Technical Analysis & Market Sentiment

Recent technical indicators suggest bullish stance on Rain Industries' stock, with notable trends including breakout from trading range, formation of bullish GARTLEY pattern, & violation of key trend lines.

Stock's performance is supported by buoyant trading volumes, indicating positive market sentiment & investor confidence in company's outlook.

4. Debt & Balance Sheet Analysis

Rain Industries' debt levels have remained relatively stable, with net debt standing at about ₹65.3 billion, supported by cash reserve of ₹23.4 billion.

However, company's balance sheet shows significant near-term liabilities outweighing available cash & receivables, raising concerns about debt repayment capability.

Company's debt-to-EBITDA ratio of 2.4x & low interest cover of 3.9x highlight potential challenges in managing debt obligations, particularly amidst declining EBIT.

5. Business Profile & Diversification

Rain Industries boasts diversified product profile, with carbon, advanced materials & cement businesses contributing substantially to consolidated revenue & EBITDA.

Company's ownership of subsidiaries such as Rain Carbon Inc & Rutgers provides financial flexibility but also exposes it to risks associated with subsidiary credit profiles.

6. Liquidity & Profitability Improvement

Rain Industries maintains adequate liquidity with cash reserves & undrawn working capital lines supporting debt reduction & routine capex.

Improvement in profitability of carbon segment, driven by ability to pass on cost fluctuations to customers & favourable currency dynamics has bolstered company's overall financial performance.

Conclusion

Despite recent surge in Rain Industries' stock price, driven by favourable valuation metrics, revenue growth prospects, technical indicators, & market sentiment, several underlying risks warrant investor caution. Challenges related to debt management, balance sheet health, & business diversification could impact company's long-term sustainability. Therefore while stock may present short-term trading opportunities, investors should conduct thorough due diligence & assess risk-reward dynamics before making investment decisions.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta