Market Outlook for 06th December 2024

Nifty Outlook for 18 August 2023

Last Updated: 18th August 2023 - 11:21 am

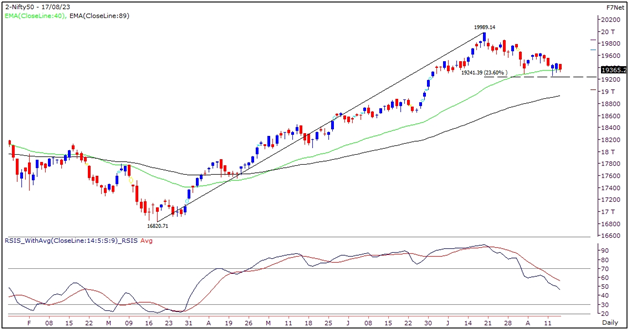

Nifty traded within the previous day's trading range on the weekly expiry day and ended below 19400 with a loss of half a percent. Although the Bank Nifty index also witnessed consolidation, it outperformed the Nifty index and ended with a ‘Doji’ candle on the daily charts.

Nifty Today:

In last three trading sessions, Nifty has consolidated within a range where resistance has been seen around 19500 while 19300-19250 range has acted as a support. The overall data is negative as FIIs have short positions intact in the index futures segment, INR has depreciated recently and is trading above the 83 mark and the global markets too have witnessed volatility amidst negative news flows. However, much of this negativity has already been factored in as the Nifty too has corrected in this month from the high of 19990 to 19300. But the market breadth has not deteriorated much which is a good sign. Now the index has formed a trading range for the short term with support around 19300-19250 range and resistance at 19650. Nifty could consolidate within this range until we see any trigger for the next directional move which would be seen only on a breakout on either side. Hence, traders are advised to trade with a stock specific approach where better trading opportunities are seen.

Indices consolidates in a range amidst stocks specific action

A break below 19250 would extend this correction towards 19000-18800 and if the data turns positive and Nifty surpasses the hurdle of 19650, then it would lead to a resumption of the broader uptrend.

Nifty, Bank Nifty Levels and FINNIFTY Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

FINNIFTY Levels |

|

Support 1 |

19300 |

43700 |

19480 |

|

Support 2 |

19250 |

43570 |

19430 |

|

Resistance 1 |

19440 |

44060 |

19620 |

|

Resistance 2 |

19520 |

44230 |

19680 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta