Stock in action – NTPC Green Energy 05 December 2024

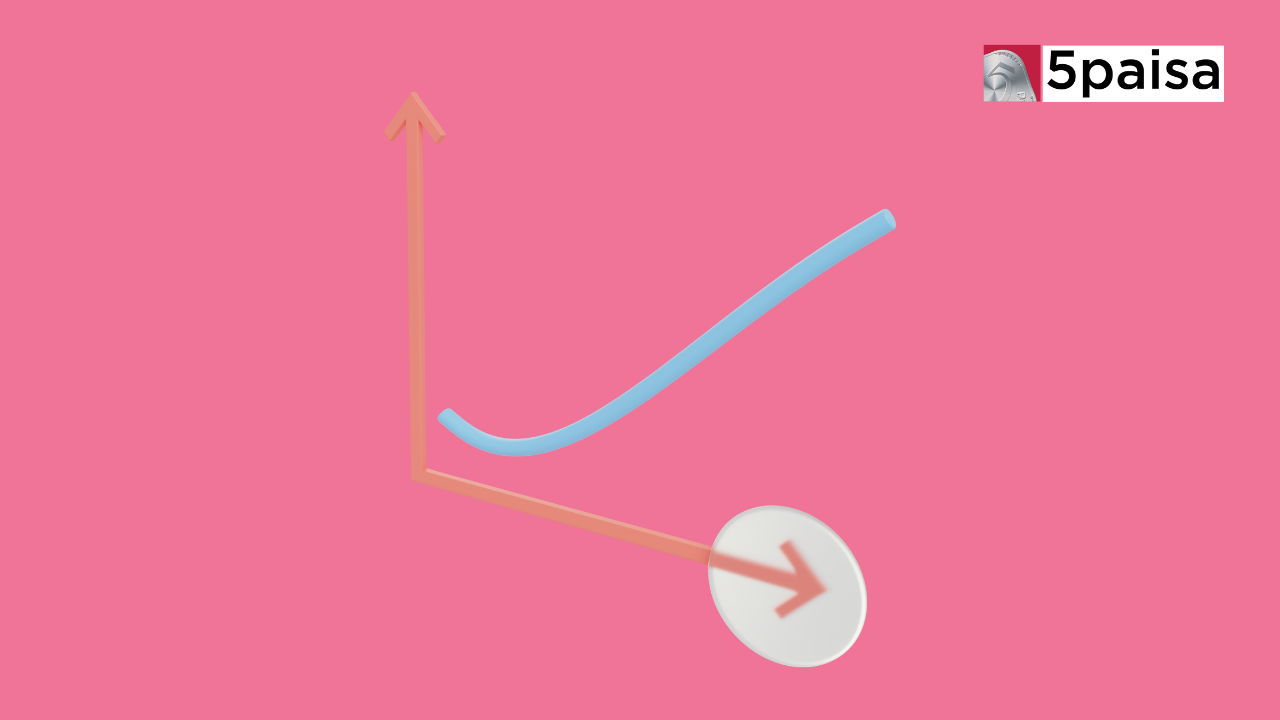

Hockey Stick Pattern Chart

Last Updated: 9th January 2024 - 06:03 pm

The hockey stick pattern chart, a distinctive formation in technical analysis, stands out as a powerful indicator for traders and investors navigating the complexities of financial markets. Resembling the iconic shape of a hockey stick, this pattern holds valuable insights into potential market movements. As we delve into the intricate world of financial charting, the hockey stick pattern chart emerges as more than a mere graphical representation. It serves as a roadmap for identifying trends and making informed decisions.

What is a Hockey Stick Chart?

The hockey stick pattern assists traders in anticipating a change in a company's performance, influencing its stock price. An upswing in a company's sales or revenue creates heightened demand for its stocks in the market, presenting traders with a potential opportunity. This pattern becomes a valuable tool for market participants seeking to gauge and capitalize on a company's financial health shifts, ultimately influencing stock market dynamics.

Resembling the shape of a hockey stick, the hockey stick pattern chart signifies a potential trend reversal or a significant upward movement in stock prices. Traders and investors keenly observe the formation of this pattern, interpreting it as an opportune moment to enter or exit positions.

What is the Relevance of a Hockey Stick Pattern?

The significance of a hockey stick pattern lies in its representation of transformative moments in business or investing. In the corporate realm, this pattern often illustrates a startup's growth trajectory or the ascent of a recently launched service. Initially marked by modest growth as market acceptance takes hold, the chart undergoes a distinctive transformation when the company or product achieves substantial success or widespread adoption. The sharp upward spike in the chart, forming the "hockey stick" pattern, signifies a pivotal phase, alerting stakeholders to significant positive shifts in performance and indicating a potentially lucrative opportunity for investors and businesses alike.

What is the Relation Between the Hockey Stick Pattern and the Stock Market?

The relationship between hockey stick patterns and the stock market provides valuable insights into various aspects of market dynamics:

• Investor Sentiment

The formation of a hockey stick pattern can reflect a positive shift in investor sentiment towards a specific stock or sector. Factors like policy changes, law amendments, alterations in corporate governance, mergers and acquisitions, new product launches, or shifts in government regulations can influence investor perceptions. This change in sentiment often leads to increased buying interest and subsequent price appreciation.

• Growth Potential

Hockey stick patterns often signal a sudden and substantial increase in a stock's price or a company's revenue, indicating rapid growth with solid fundamentals. This surge suggests that the company is performing well within its industry, attracting investors seeking hockey stick pattern trading from entities exhibiting robust and steady growth potential.

• Market Speculation

While a hockey stick pattern may indicate sustainable growth, it can also result from short-term market speculation without a solid fundamental basis. In such cases, the price increase might not be sustainable in the long term, potentially leading to a correction.

The hockey stick pattern chart is valuable for traders and investors, offering insights into potential market shifts. Its ability to signify growth potential, reflect investor sentiment and highlight market speculation enhances its significance in strategic decision-making, contributing to informed and profitable actions in the dynamic world of finance.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta