Stock in action – NTPC Green Energy 05 December 2024

Fundamental Analysis of Polycab India

Last Updated: 8th September 2023 - 03:34 pm

Polycab's Journey Through Time

Back in 1964, in the bustling city of Mumbai, something extraordinary began. A man named Thakurdas Jaisinghani laid the foundation for a business that would forever change India's electrical landscape. He opened a modest store called 'Sind Electric Stores,' offering a wide range of electrical products like fans, lights, switches, and wires. Little did he know that this small shop would become the foundation of something remarkable.

As time went on, Thakurdas' four sons, Girdhari, Inder, Ajay, and Ramesh, took charge of the family business. Together, they established 'Thakur Industries, following the Indian Partnership Act of 1932, setting the stage for what was to come and marking the beginning of their journey towards becoming an industry giant.

In 1975, a significant milestone was reached when the family entered into a lease agreement with MIDC (Maharashtra Industrial Development Corporation). This lease was for a piece of land in the thriving Andheri area of Mumbai. On this land, they built a factory dedicated to producing cables and wires, meeting the ever-growing demand for electrical products.

Then, in 1983, a new chapter unfolded as 'Polycab Industries' was born. Founded by Girdhari T. Jaisinghani, Inder T. Jaisinghani, Ajay T. Jaisinghani, and Ramesh T. Jaisinghani. This venture aimed to revolutionize the industry by manufacturing PVC-insulated wires and cables, copper and aluminum products, and bare copper wire.

Fast forward to 1996, when 'Polycab Wires Private Limited' was established under the Companies Act of 1956. This move allowed them to expand their reach and solidify their position as a leading player in the electrical industry.

By 1998, 'Polycab Industries Private Limited' had emerged, solidifying its position as a leading player in the electrical industry. The transition to a private limited entity reinforced their commitment to providing top-notch electrical solutions to customers nationwide.

The company's relentless growth continued, and in 2018, it achieved a monumental milestone by becoming a public limited company. Alongside this transformation came a change in name, from Polycab Industries to Polycab India Limited. This change signified their enduring dedication to the Indian electrical landscape.

Today, Polycab India Limited stands tall as a symbol of innovation, reliability, and excellence in the electrical industry. What started as Sind Electric Stores has evolved into a publicly traded powerhouse, all thanks to the vision, hard work, and dedication of the Jaisinghani family.

Business Overview

Polycab India holds a significant market share of over 24% in the manufacturing and sale of wires, cables, and fast-moving electrical goods (FMEG) under the 'POLYCAB' brand. Their product range extends beyond wires and cables to include electric fans, LED lighting, luminaires, switches, switchgears, solar products, and conduits with associated accessories.

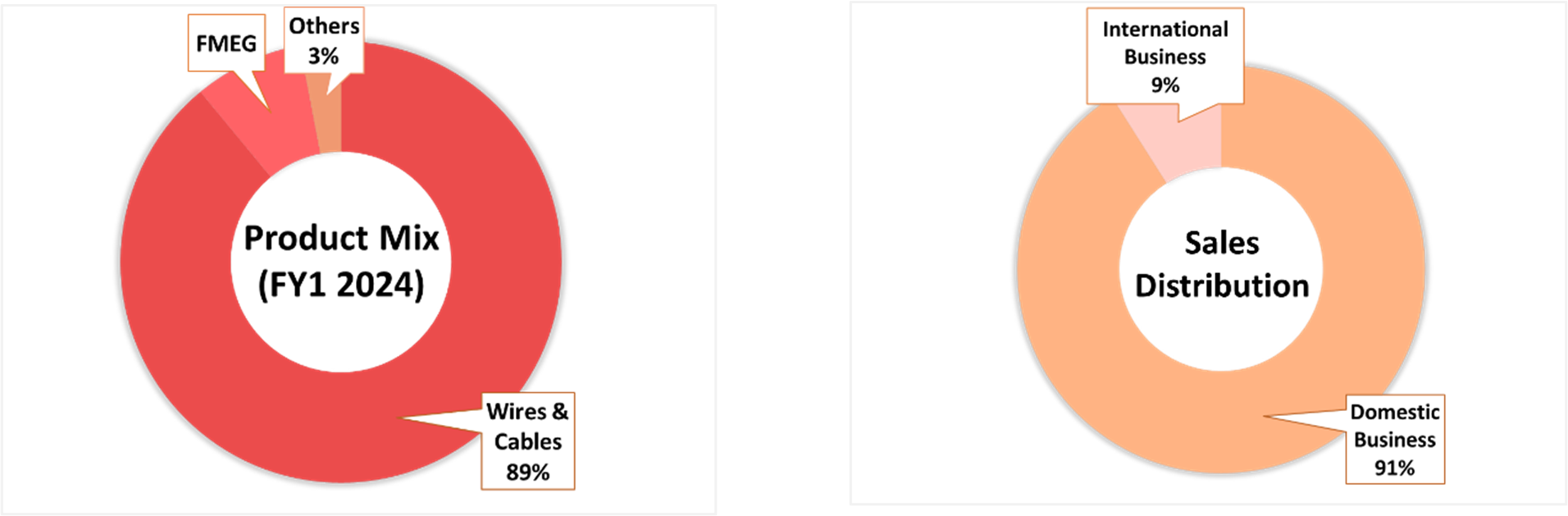

In the current quarter of FY1, 2024, Polycab's product mix predominantly consists of wires and cables, accounting for 89% of their offerings. Fast-moving electrical goods (FMEG) contribute 8%, while other products make up the remaining 3%.

In terms of sales, the majority, at 91%, is driven by domestic business, reflecting Polycab's strong presence in the local market. International business plays a smaller but significant role, making up 9% of their overall sales, indicating their expanding global footprint.

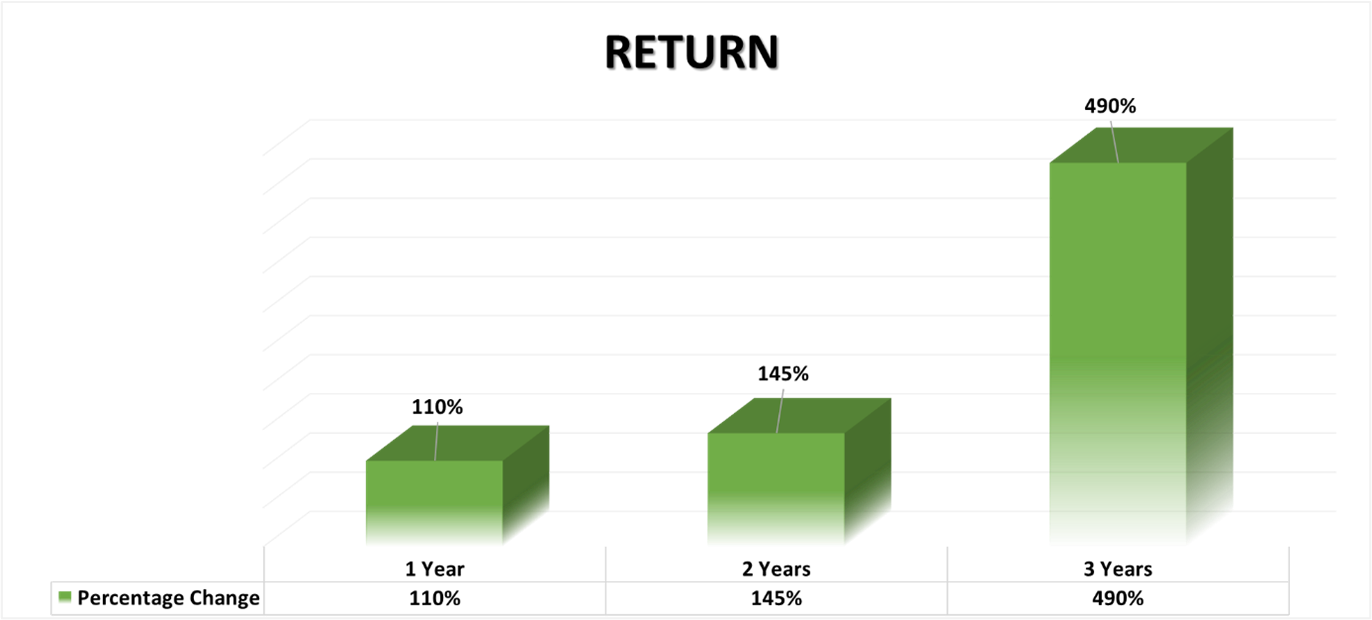

Return Percentage Over Various Periods

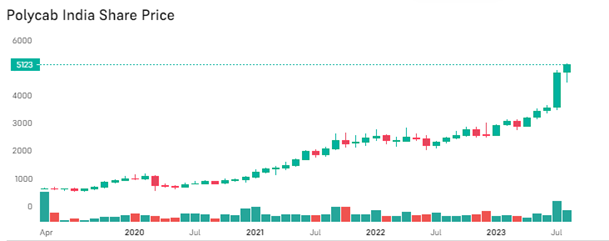

Finally, when we consider the company's price performance, it becomes evident that Polycab India has delivered substantial returns to investors over various periods. Notably, the one-year return stands at an impressive 109.72%, while the three-year return is an astounding 490.24%. These figures underscore Polycab India's consistent track record of delivering significant value and growth to its investors.

Key Financial Metrics

| Company Essentials | Value |

| Market Cap | ₹78,119.22 Cr. |

| Face Value | ₹10 |

| Current Price | ₹5,208 |

| 52 Week High | ₹5,166 |

| 52 Week Low | ₹2,451.10 |

| Industry P/E | 56 |

| Stock P/E | 53.63 |

| P/B | 11.19 |

| Div. Yield | 0.38% |

| Debt | ₹82.13 Cr. |

| EPS (TTM) | ₹97.12 |

Cash Flow of Polycab India (INR. Cr.)

This table provides insight into Polycab India Limited's cash flow over five years, showing the ups and downs in its financial journey. Polycab India faced both good and challenging periods in its cash flow, which were influenced by how well it ran its operations, the investments it made, and how it managed its finances. Notably, in recent times, the company has shown resilience and adaptability, as seen in its positive net cash flow, indicating it can handle financial challenges effectively.

| PARTICULARS (Consolidated) | MAR 2020 | MAR 2021 | MAR 2022 | MAR 2023 |

| Cash from Operating Activity | 244 | 1,252 | 511 | 1,427 |

| Cash from Investing Activity | -262 | -1,012 | -426 | -1,202 |

| Cash from Financing Activity | 11 | -174 | -200 | -227 |

| Net Cash Flow | -6 | 65 | -116 | -2 |

| Net Cash Flow(% Change) | -103.5% | 1183.3% | -278.5% | 98.3% |

Yearly Financial Snapshot

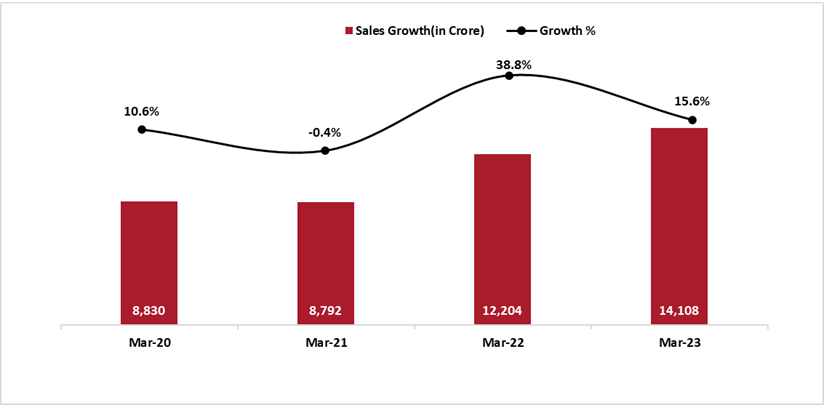

Sales Growth: The company's sales revenue has been steadily increasing over the four-year period. There was a notable jump in sales from March 2021 to March 2022, with a further increase in the most recent year, March 2023. This indicates healthy revenue growth for the company.

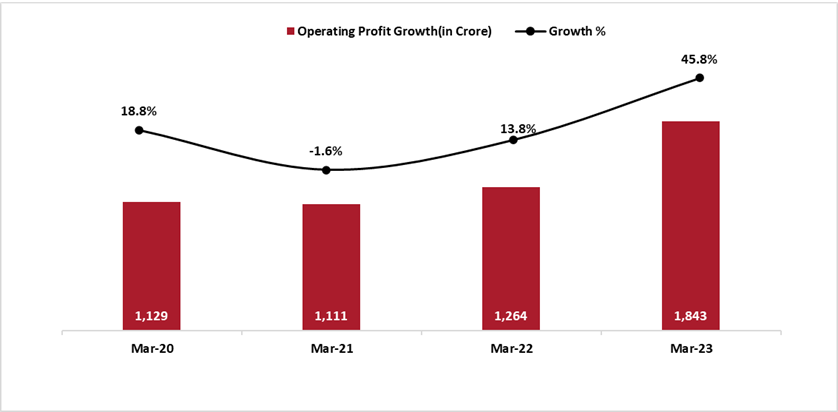

Operating Profit: The operating profit has also been on an upward trend over the four years. There was a gradual increase in operating profit from March 2020 to March 2022 and a more significant increase in March 2023. This suggests that the company has been able to manage its operating expenses effectively while increasing its sales.

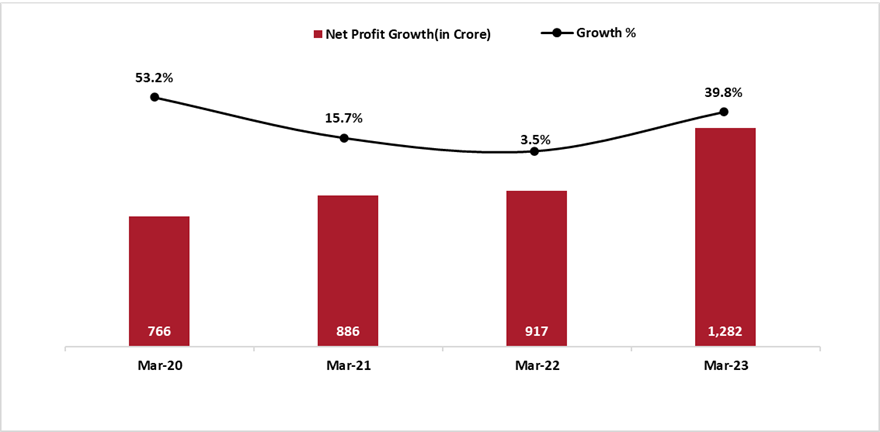

Net Profit: The net profit (or bottom line) of the company has followed a similar growth trajectory. It has consistently increased from March 2020 to March 2023. This indicates that the company has not only been successful in increasing its revenue but also in managing its expenses and achieving higher profitability.

Key Financial Ratios

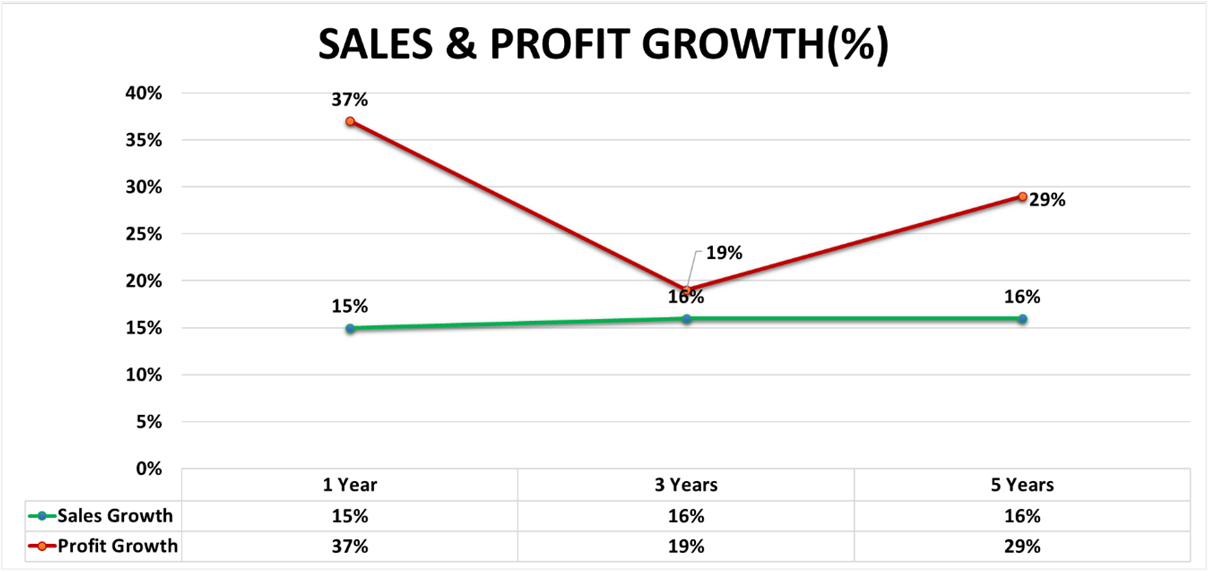

Sales Growth:

• The most recent 1-year period, the company experienced a 15% growth in sales, signalling a positive trend in revenue generation.

• This growth, although slightly lower than the average growth rate of the last 3 and 5 years (both at 16%), still reflects a healthy and expanding sales performance in the short term.

Profit Growth:

• Over the last 5 years, the company achieved a profit growth rate of 29%, indicating significant improvement in profitability over this period.

• In the last 3 years, the profit growth rate was slightly lower at 19%, which, while positive, showed a deceleration compared to the previous 5 years. In the most recent 1-year period, there was a substantial surge in profit growth to 37%, signifying a remarkable increase in profitability compared to the preceding 3 years.

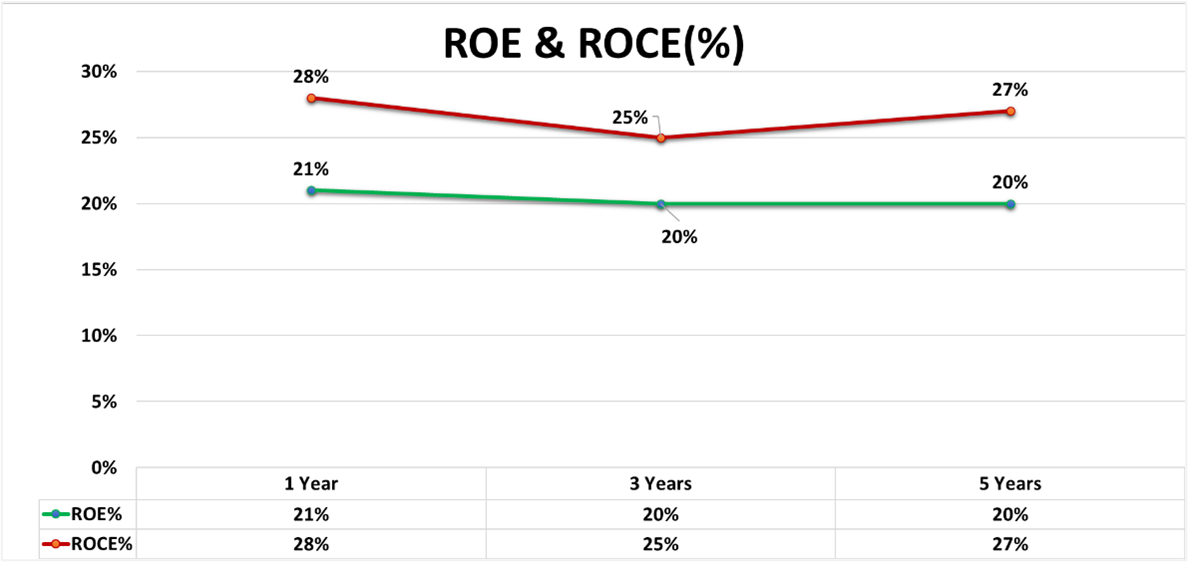

ROE Ratio:

Return on Equity (ROE) is like a report card for a company. It shows how good the company is at using the money that its owners (shareholders) have invested. A higher ROE means the company is doing a good job of turning the shareholders' investment into profits.

• In terms of Polycab, the recent uptick in Return on Equity (ROE) from 20% (5-year period) to 21% (most recent year) indicates a slight improvement in the company's ability to generate profits for its shareholders in the most recent year.

ROCE Ratio:

Return on Capital Employed (ROCE) is a financial metric that measures a company's profitability and efficiency in using its capital to generate earnings. In simpler terms, ROCE helps investors and analysts understand if a company is using its debt (like loans) and equity (like shares) efficiently to make money. A higher ROCE generally indicates that the company is doing a better job at this, while a lower ROCE suggests that the company might not be using its capital as efficiently. It's an important metric to evaluate a company's financial health and performance.

• In terms of Polycab, the increase in ROCE from 25% (3-year period) and 27% (5-year period) to 28% (most recent year) suggests that the company has become more efficient in using its total capital to generate profits.

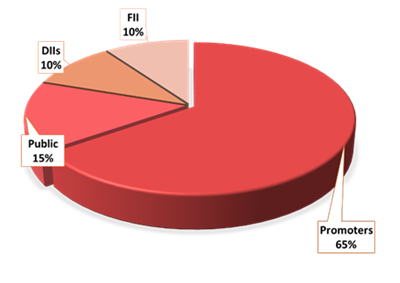

Polycab India’s Shareholding Pattern

The majority of the company’s stake (66%) is owned by its promoters, showing a strong commitment to its success. The public holds 15%, while domestic and foreign institutional investors (DIIs and FIIs) each have a 10% stake. This diverse ownership structure contributes to the company's stability and performance in the stock market.

Price Analysis

In 2019, Polycab India debuted successfully in the financial market, with its IPO closing at 21% premium over the issue price of ₹538. The ₹1,345 crore public offering was oversubscribed by an impressive 51.96 times, reflecting strong investor confidence.

Since its listing, Polycab has consistently delivered substantial returns, offering investors more than a 700% return. In just one year, Polycab has given 110% return, and in two years, a remarkable 133% return. Polycab has undoubtedly proven itself as a notable wealth creator for its shareholders.

Polycab India: A Glimpse into Future Growth Potential

In India's changing economy, Polycab India is a big player that's closely connected to the country's growth. They're dedicated to making top-quality products for India and the world. Now, let's look at how Polycab can grow in the future, especially in India's wires and cable market, which is always changing.

Current Market Scenario:

Currently, in India, the market for wires and cables is quite substantial, valued between ₹68,000-73,000 crores. But the exciting part is that it's expected to get even bigger, potentially reaching ₹90,000-95,000 crores by the fiscal year 2026.

Here's why:

• Real Estate Boom: The real estate sector is booming, which means lots of new buildings and homes are being constructed. All these new places need a lot of electrical wiring and cables to work properly.

• Government Infrastructure Investments: Increased government spending on infrastructure development is creating a surge in demand for electrical products.

• Renewable Energy Focus: The shift towards renewable energy generation calls for robust electrical networks, further boosting the demand for cables and wires.

• Telecom Upgradation: Ongoing telecom network upgrades necessitate advanced wiring solutions.

Polycab Growth Outlook

In 2023, Polycab is planning to invest a substantial amount of money, around ₹600-700 crores, in its business. They are focusing this investment on two important areas: wires & cables and fast-moving electrical goods (FMEG). This means they want to invest this money to improve and strengthen these parts of their business.

In its five-year plan spanning FY21-26, Polycab aims to achieve the following objectives:

• Achieve its revenue to ₹20,000 crores by FY26.

• Achieve 1.5 times market growth in core segments.

• Realize 2 times market growth in emerging segments.

• Achieve 2 times market growth in the FMEG segment.

• Achieve an EBITDA margin of 10-12% in the FMEG segment.

• Secure over 10% of its contribution from online channels.

Conclusion

Polycab's journey over the years shows how it has grown and adapted to become a big player in the electrical industry. It started as a small electrical store in 1964.

The company has done well financially, with steady increases in sales, operating profit, and net profit. It also manages its money well, which is seen in its positive cash flow, showing that it handles its finances and changes in the market.

Looking forward, Polycab has plans to grow even more. They want to invest in strategic things, make more money, and meet the increasing demand for their products both in India and around the world.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta