Market Outlook for 06th December 2024

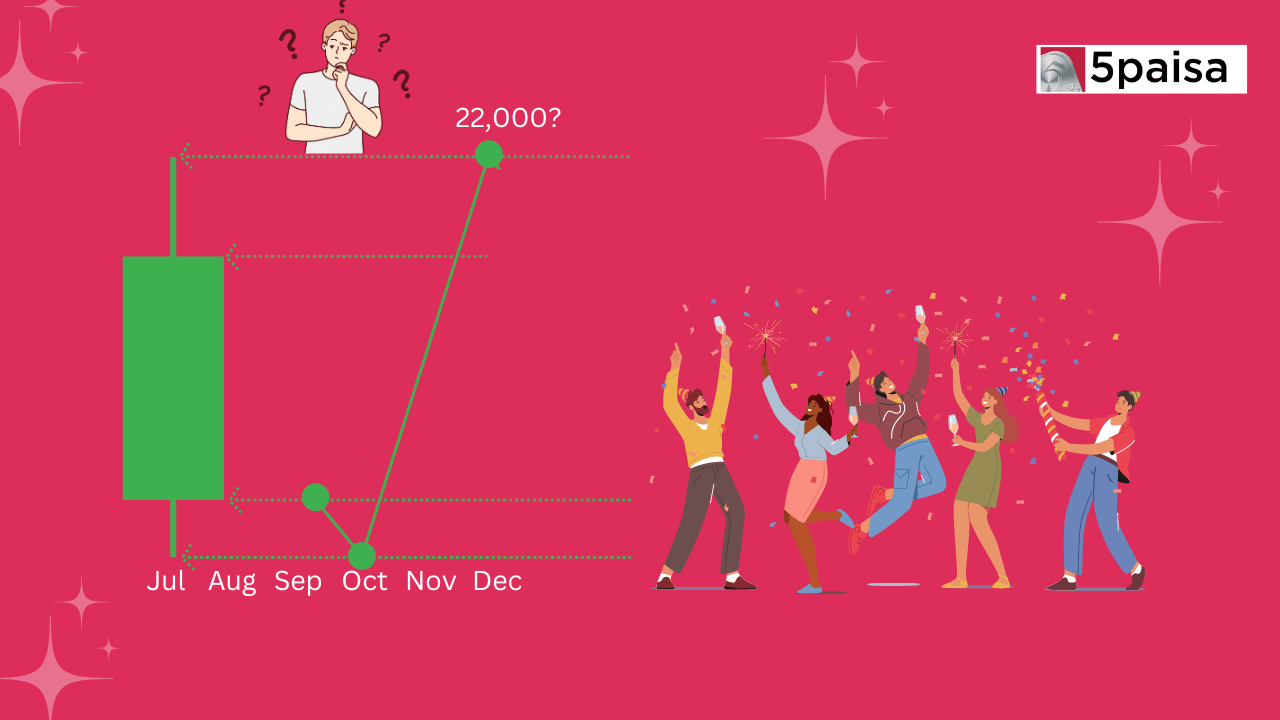

Can Nifty Reach 22,200 Before the Year Ends?

Last Updated: 9th August 2023 - 04:19 pm

The Indian equity market has been a source of long-term growth potential, and experts believe it continues to hold promise for savvy investors. A recent analysis by a seasoned professional sheds light on key factors driving this optimism and unveils potential strategies for navigating this dynamic landscape.

Economic Landscape and Outlook:

The evolving economic structure and a surge in capital expenditure are expected to fortify the Indian equity market. These developments are projected to bolster the credit growth of banks, with a focus on sectors like BFSI witnessing robust growth. The projection of a sustained healthy business risk profile over the medium to long term forms a foundational element of this positive outlook.

Growth Drivers:

The strategic emphasis on expanding capacity and optimizing product offerings aligns with the market's trajectory. An anticipated soft landing in the US market and an overall reduction in volatility are seen as drivers that could contribute to a higher market valuation.

Sectoral Insights:

The BFSI sector's resilience in the face of economic fluctuations has positioned it as a top contender. Banks and NBFCs are expected to leverage improved balance sheets and superior return ratios, setting the stage for potential investment opportunities. Additionally, a theme focused on "Growth at a Reasonable Price" gains prominence due to factors such as a favorable agricultural season, moderating commodity prices, rural resurgence, and projected margin recovery.

Public and Private Banking Dynamics:

The banking sector as a whole has shown remarkable progress compared to pre-pandemic levels. PSU banks, in particular, exhibit enhanced balance sheets and improved return ratios. The potential for expansion in return on equity (ROE) further augments the investment case for large-cap PSU banks, making them an attractive proposition for investors considering a horizon of 12-18 months.

Equity Market Projection:

The projection for the Indian equity market remains positive, anchored in the anticipated growth in credit facilitated by increasing capital expenditure. A growth estimate of 16 percent/13 percent in FY24/FY25 underscores this outlook. While the base target is set at a valuation of 20x on December FY24 earnings, a bull case scenario envisions a valuation of 22x, leading to a potential target of 22,200 by December 2023. The US market's trajectory and the evolving interest rate scenario are among the factors influencing this optimistic stance.

Emergence of New-Age Companies:

The evolution of new-age companies is a notable trend. With a renewed focus on profitability, these companies present a unique investment opportunity. While challenges persist and consistency in profitability remains a key consideration, the shift towards sustainable profitability bodes well for investors willing to adopt a horizon beyond 12-18 months.

Navigating NBFCs:

Non-Banking Financial Companies (NBFCs) are poised for a positive turn as the rate hike cycle nears its peak. Forecasts of potential rate cuts around mid-2024 and the changing interest rate environment are expected to translate into margin benefits for well-capitalized NBFCs. A solid credit book, robust management, and strong capitalization elevate the appeal of NBFCs as a prudent investment avenue.

In conclusion, the Indian equity market continues to exude promise, underpinned by evolving economic dynamics, sectoral growth, and a focus on profitability. Both established sectors and emerging players hold potential for investors willing to embrace a strategic approach and a patient investment horizon. As always, market conditions may evolve, but the principles of insightful analysis and prudent decision-making remain the bedrock of successful investing.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta