LIC IPO

The LIC IPO is set to become one of the biggest IPOs to date, as India's largest insurance company is set to file the draft red herring p...

IPO Details

- Open Date

04 May 2022

- Close Date

09 May 2022

- IPO

Price Range

₹ 902 to ₹ 949

- IPO

Size

₹ 21,000 Cr

- Listing Exchange

NSE,BSE

- Listing Date

17 May 2022

IPO Timeline

Last Updated: 13 May 2022 9:53 AM by 5Paisa

Out of the total paid up capital of 632,49,97,701 shares (approx. 632.50 crore shares), LIC plans to offer a total of around 22 crores to the public by way of offer for sale. There will be no fresh issue component in the LIC IPO and the entire IPO will be by way of offer for sale only.

This translates approximately to about 3.5% of the total outstanding equity of LIC. Hence the total of the government in LIC will come down post the IPO from 100% to 96.5% while the public will hold 3.5% post the IPO in LIC. The price band for the IPO is set at Rs 902 – 949 per share resulting in an implied market capitalization of Rs 6 lakh crore for the company.

The IPO is expected to open on 4th May, 2022 and will close on 9th May, 2022. The government delayed the issue due to the Russian-Ukraine war.

From the offer for sale (OFS) 10 percent of the shares are reserved for LIC policyholders, 0.7 percent for LIC employees and 31.25 percent is reserved for household (retail) investors.

Applicants from retail and employee categories will get a discount of Rs 45 while it is Rs 60 for policyholders on the actual offer price. For these categories, the maximum application is restricted to Rs 2 lakh, implying 230-odd shares at the lower price band after discount.

LIC IPO has received ₹13,000 crore worth of investment commitments from anchor investors, more than twice the value of shares offered to such investors.

Economics of the Life Insurance Industry

There are several factors that set the perfect undertone for the growth of insurance business in India. Some pertain to macro advantages, some to demographic dividends and some to the extent of penetration of financial inclusion. Here are some highlights.

a) India currently has a total population of 1.2 billion spread across 24.5 crore households and ranked fifth in the world on total GDP with a share of 3.1% of world GDP.

b) India has the largest army of young people with median age of 28. Over 90% of Indians are below the age of 60, opening a huge life insurance market.

c) Urban population is expected to rise to 37% in FY2025, entailing higher personal risk and greater need for life insurance.

d) There is a middle class explosion in India. Households with income under Rs.2 lakhs fell from 83% in 2012 to 65% in 2022. That is a lot of purchasing power.

e) Despite 77% overall literary, level of financial literacy is just 27%, leaving a huge potential for financialization of savings, including the potential for insurance.

f) Share of financial assets in household savings pool has gone up sharply from 31% in FY12 to 41% in FY21 and continues to grow at a rapid pace.

g) Gross financial savings in India have grown at a CAGR rate of 12% on average between FY13 and FY21, giving a thrust to financialization of savings.

h) Share of life insurance in Indian household savings has gone up from 16.8% in FY19 to 19.4% in FY21, largely on account of higher awareness of life insurance post COVID-19.

i) Pradhan Mantri Jan Dhan Yojana (PMJDY) to ensure bank account for every Indian, has been a big catalyst for the growth of digital sales of insurance.

j) Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) for Universal Insurance has seen cumulative enrolments grow from 30 million in FY17 to 71 million in FY21

k) Pradhan Mantri Suraksha Bima Yojana (PMSBY) for underprivileged classes has seen enrolments rise from 94 million in FY17 to 185 million in FY21.

In short, there have been several catalysts for the rapid growth and penetration of life insurance in India; some push and some pull factors.

History of Life Insurance Corporation (LIC) of India

The Insurance Act, 1938 was the first legislation governing not only life insurance but also non-life insurance to regulate the insurance industry. Life insurance in India was nationalized on January 19, 1956. The Parliament of India passed the Life Insurance Corporation Act on June 19, 1956, and the Life Insurance Corporation of India (LIC) was created on September 1, 1956 with the objective of spreading life insurance, in particular to rural areas and to socially and economically disadvantaged classes. The idea was to offer social security in the form of adequate financial coverage against death at a reasonable cost.

Today, LIC continues to be the largest life insurer in India despite 25 years of private sector competition. LIC is the largest life insurer in India in terms of GWP, NBP, number of individual policies issued and number of group policies issued as of Fiscal 2021. LIC had 28.6 core in-force policies under Individual Business (within India) as at March 31, 2021, which is greater than the 4th largest country population-wise. As on September 30, 2021, LIC had a market share of 64.49% in NBP (individual and group) as compared to next largest competitor who had a market share of 7.79% in NBP (individual and group). As at September 30, 2021 LIC operates through 8 zonal offices, 113 divisional offices and more than 4,700 branch/satellite and mini offices. NBP for LIC in Fiscal 2021 was over Rs. 1.8 trillion, representing 66% of the aggregate industry NBP

| Particulars (in Rs. Crores) | FY21 | FY20 | FY19 |

|---|---|---|---|

| Revenue | 29855.71 | 27309.56 | 26449.96 |

| EBITDA | 2980.3 | 2718.5 | 2642.3 |

| PAT | 2974.1 | 2710.5 | 2627.4 |

| Particulars (in Rs. Crores) | FY21 | FY20 | FY19 |

|---|---|---|---|

| Total Assets | 3746404.5 | 3414174.6 | 3366334.6 |

| Shareholder's Fund | 6983.2 | 1098.1 | 897.4 |

| Total Liabilities | 3739417.9 | 3413047.7 | 3365423.9 |

| Particulars (in Rs. Crores) | FY21 | FY20 | FY19 |

|---|---|---|---|

| Net cash generated from / (used in) operating activities | 80602.04 | 54366.92 | 13273.81 |

| Net cash from / (used in) investing activities | 148792.31 | -41809.09 | 8764.50 |

| Net cash flow from / (used in) financing activities | -256125.5 | -18663.7 | -13699.6 |

| Net increase (decrease) in cash and cash equivalents | -27076.66 | -4711.62 | 9210.50 |

Peer Comparison

Here are some key parameters on which LIC can be compared with the large life insurance companies in India. LIC has the highest profits among the peer group and its PE ratio will only be known once the pricing is fixed. However, LIC RONW is way about the peer group as you can see in the table below.

| Name of the company | Net Profit (in Rs. crores) | Networth (in Rs. Crores) | Basic EPS | NAV Rs. per share | PE | RoNW % |

|---|---|---|---|---|---|---|

| Life Insurance Corporation of India | 2974.1 | 6514.6 | 4.7 | 10.3 | NA | 45.7% |

| SBI Life Insurance Company Limited | 1455.8 | 10400.4 | 14.56 | 103.99 | 81.46 | 14.0% |

| HDFC Life Insurance Company Limited | 1360.9 | 8637.7 | 6.74 | 42.75 | 94.26 | 15.8% |

| ICICI Prudential Life Insurance Company Limited | 956.2 | 9119.4 | 6.66 | 63.51 | 81.83 | 10.5% |

How does LIC compare with the global peer group in terms of key parameters like GWP and Total assets. Given below is an international comparison of LIC with some of the largest life insurance companies in the world ranked by the Life premiums earned. With annual premiums in excess of $55 billion, LIC ranks fifth among life insurers in the world.

| Company Name | Country | Gross Written Premium $m (2020) | Total Assets $m (2020) | Life Premiums $m (2020) |

|---|---|---|---|---|

| Allianz SE | Germany | 99,583 | 1,272,014 | 88,853 |

| Ping An Insurance | China | 115,635 | 1,380,851 | 74,134 |

| China Life Insurance | China | 88,734 | 616,291 | 69,651 |

| Assicurazioni Generali S.p.A | Italy | 84,845 | 653,652 | 58,268 |

| LIC of India | India | 56,405 | 507,333 | 56,405 |

| Nippon Life Insurance | Japan | 39,838 | 705,002 | 39,838 |

| AXA S.A | France | 112,698 | 965,747 | 37,829 |

| Japan Post Insurance | Japan | 24,369 | 633,845 | 34,223 |

| Dai-chi Life Holdings | Japan | 41,644 | 559,853 | 27,024 |

| North Western Mutual | US | 19,323 | 308,767 | 15,720 |

| MetLife Inc. | US | 49,486 | 795,146 | 14,200 |

| People’s Insurance of China | China | 75,447 | 182,038 | 13,665 |

LIC Key Ratios comparison

Here we look at how LIC compares with competition on some of the most important ratios pertaining to the life insurance business.

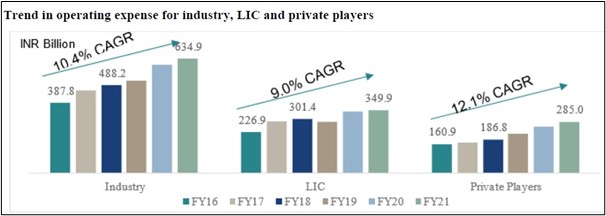

As can be seen from the above table, the operating expenses growth over the last 5 years has been the lowest for LIC at 9%. It is much higher at 12.1% for private insurers and sharply the industry average of 10.4% also makes LIC operating expense growth look attractive.

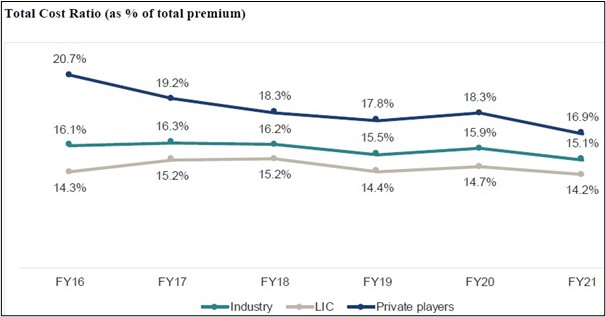

Let us now turn to a comparison on total cost ratio.

Evidently, even in the case of total cost ratio, LIC is much lower than the private players and lower than other private insurers too. The total cost ratio for LIC has been gradually trending lower as is evident in the graphic.

Let us now turn to the share of LIC and its competitors in annuity products.

| Share of annuity products | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|

| LIC | 19.8% | 20.3% | 21.2% | 21.1% |

| HDFC Life | 9.0% | 17.3% | 15.6% | 19.5% |

| ICICI Prudential | 0.4% | 0.9% | 1.4% | 3.5% |

| Max Life | 3.0% | 2.3% | 3.7% | 7.8% |

| SBI Life | 0.8% | 0.8% | 2.8% | 6.0% |

LIC and HDFC Life have a sizable share of annuity products for FY21. This is likely to improve profit retention in these two companies.

Let us now turn to the market share of LIC vis-à-vis competition based on various volume and value revenue sources.

| Market Share – FY21 | Total Premium | New Business Premium | Renewal Premium | No. of Policies (Individual) | No. of Policies (Group) |

|---|---|---|---|---|---|

| LIC | 64.10% | 66.20% | 62.50% | 74.60% | 81.10% |

| SBI Life | 8.00% | 7.40% | 8.50% | 5.90% | 1.30% |

| HDFC Life | 6.10% | 7.20% | 5.20% | 3.50% | 0.70% |

| ICICI Prudential Life | 5.70% | 4.70% | 6.50% | 2.40% | 7.40% |

| Max Life | 3.00% | 2.40% | 3.50% | 2.30% | 1.00% |

| Bajaj Allianz Life | 1.90% | 2.30% | 1.60% | 1.50% | 0.60% |

| Others | 11.20% | 9.80% | 12.20% | 9.80% | 7.90% |

| Private players total | 35.90% | 33.80% | 37.50% | 25.40% | 18.90% |

LIC still dominates in the area of total premium and also in new business premium. However, LIC appears to dominate the volume story more emphatically with its 74.6% market share of number of individuals policies and an impressive 81.1% of group policies.

How does LIC compare with the peer group on commissions and OPEX?

| Expense ratios (as % of total premium)-FY 21 | Commission ratio | Operating expense ratio | Total Cost Ratio |

|---|---|---|---|

| LIC | 5.5% | 8.7% | 14.2% |

| SBI Life | 3.5% | 4.8% | 8.3% |

| HDFC Life | 4.4% | 11.9% | 16.3% |

| ICICI Prudential Life | 4.2% | 7.5% | 11.7% |

| Max Life | 6.5% | 14.2% | 20.7% |

| Bajaj Allianz Life | 4.8% | 16.0% | 20.8% |

| Median of Top 5 private players | 4.4% | 11.9% | 16.3% |

LIC has a commission pay-due to its specific business model For LIC, the operating expense ratio is competitive but it is higher than SBI Life and of ICICI Prudential Life. Let us now turn to the sales channel that various players dominate.

| Channel Mix (Individual NBP) - % (FY21) | Individual agents | Corporate agents - Banks | Corporate agents - Others | Direct Business | Web Aggregators | Others |

|---|---|---|---|---|---|---|

| LIC | 93.80% | 3.10% | 0.10% | 2.20% | Nil | 0.80% |

| SBI Life | 27.70% | 65.40% | 2.80% | 4.10% | N.A. | 0.00% |

| HDFC Life | 12.30% | 45.80% | 3.80% | 32.90% | 0.50% | 4.70% |

| ICICI Prudential Life | 24.70% | 46.80% | 5.00% | 17.10% | 0.70% | 5.60% |

| Max Life | 26.20% | 63.50% | 1.80% | 8.30% | N.A. | 0.20% |

| Bajaj Allianz Life | 41.60% | 32.20% | 2.40% | 12.40% | 6.20% | 5.10% |

What the above table shows is that LIC has clear domination in terms of individuals agents acting as a funnel for sales. The share of individual agents is substantially lower in the case of other insurance. The reverse is true of corporate agents and Direct business wherein LIC has a much lower ratio compared to the private players.

Let us now compare insurance companies on employee productivity.

| Parameters- FY21 | Number of employees | NBP per employee (INR) | Revenue per employee (INR) |

|---|---|---|---|

| LIC | 114,498 | 16,085,396 | 254,327 |

| SBI Life | 17,4648 | 12,053,572 | 1,386,494 |

| HDFC Life | 20,636 | 9,900,198 | 801,340 |

| ICICI Prudential Life | 14,413 | 8,974,362 | 1,898,509 |

| Max Life | 14,000 | 4,876,343 | 453,414 |

| Median of Top 5 private players | - | 9,437,280 | 1,093,917 |

LIC has the highest number of employees, which is hardly surprising. However, its new business premium (NBP) per employee is still the best in the industry. However, LIC lags way behind the peer group in terms of overall revenues per employee.

Let us now compare the insurance companies on their rural reach.

| Bank Partners’ Branch | Rural | Semi-urban | Urban | Metropolitan | Total |

|---|---|---|---|---|---|

| LIC | 15,362 | 13,571 | 11,133 | 11,567 | 51,633 |

| SBI Life | 11,930 | 10,753 | 7,969 | 7,374 | 38,026 |

| HDFC Life | 4,202 | 6,249 | 3,931 | 4,267 | 18,649 |

| ICICI Prudential Life | 1,999 | 3,398 | 2,870 | 3,750 | 12,017 |

| Max Life | 917 | 1,726 | 1,365 | 1,922 | 5,930 |

| Bajaj Allianz Life | 3,411 | 5,084 | 3,504 | 3,497 | 15,478 |

The above table makes it clear that LIC and SBI life have the clear advantage when it comes to branches in rural and semi-urban areas. While LIC also dominates the urban and metro markets, it is in rural and semi-urban centres that LIC really scores over the peer group.

Finally, let us compare insurance companies on quality of bond portfolio held.

Strengths:

• Strong dedicated army of individual agents

• Has been generally proactive in launch of products and strategies

• Highly skilled and trained workforce with proprietary training programs

• Strong brand advantage and rated as the most valuable brand in India

• Big focus on technology and automation to focus on standardization

Risks:

• As the company is a public sector unit, it faces a lot of rules and restrictions

• Their internal policies need to be amended according to the fiscal and monetary policy changes of the country

Weakness:

• There still exist gaps in the product portfolio offered by LIC

• Profitability ratios and Net Contribution need improvement

• Limited success outside core business of life insurance

• Non-performing assets in debt portfolio remains high

• At the end of the day, LIC has lost 25% market share to private players.

LIC – The Road Ahead

Here is what LIC is likely to focus on in the road ahead.

• Stable free cash flow can be extensively leveraged for investing in technology, new product segments and new innovations.

• Big focus on digital not only for sales and as a platform but also for rethinking LIC business process flow from KYC to selling.

• A substantially omnichannel approach to selling insurance with greater integration of offline and online models of insurance selling.

• One of the big focus areas is shifting out of the predominant agent driven model to a sales model that is more system and formula driven.

in 3

Using 5paisa App or

Website

to block Payment

FAQs

The government of India is diluting its partial stake in Life Insurance Corporation of India (LIC) by launching the IPO and inviting the public to participate in its equity. The issue is entirely an offer for sale (OFS) by the government of India, which will offload 22.13 crore equity shares, aggregating to a 3.5 per cent stake of the company.

The Government of India aims to raise ₹21,008.48 crore from this public issue. Hence, LIC IPO will be the largest ever IPO in India.

LIC IPO will open for subscription on 4th May 2022 and closes on 9th May 2022.

Yes, LIC policyholders can apply for IPO issue. The prerequisites to be eligible for IPO under policyholder category are:

- PAN details of the policyholder should be updated on LIC portal

- Policy holder should have a demat account

Step 1: Visit LIC website – www.licindia.com and click on ‘Online PAN registration’

Step 2: Enter details including date of birth, email ID, name as per PAN, mobile number and policy number. If there are multiple policies, add all the policy numbers

Step 3: Enter the mobile number OTP which will be sent to the registered mobile number of policyholder

Step 4: After authentication, check the status on ‘Online checking policy PAN status’

Investors can bid for shares in a lot size of 15 shares and in multiples thereof. At the upper range of the price band, one lot of LIC IPO will be worth Rs.14,235 exclusive of any discount.

Union government has appointed 10 merchant bankers for managing LIC IPO - Goldman Sachs (India) Securities, Citigroup Global Markets India, Nomura Financial Advisory and Securities India, SBI Capital Market, JM Financial, Axis Capital, BofA Securities, JP Morgan India, ICICI Securities and Kotak Mahindra Capital Co Ltd

LIC policyholders will get a discount of Rs.60 per share.

Union government has appointed Kfintech as the registrar of the LIC IPO.

The LIC IPO is going to get listed on NSE and BSE.

The price band of the LIC IPO is set at Rs.902 to Rs.949 per equity share.

Retail investors & employees of LIC will get a discount of Rs.45 per share.

Two things are necessary while applying for LIC IPO:

1. Demat Account

2. Pan Card

Contact Information

LIC

Life Insurance Corporation of India (LIC)

Yogakshema, Jeevan Bima Marg

Nariman Point, Mumbai 400 021,

Phone: +91 22 6659 8732

Email: investors@licindia.com

Website: https://www.licindia.in/

LIC IPO Register

KFin Technologies Limited

Phone: 04067162222, 04079611000

Email: lic.ipo@kfintech.com

Website: https://karisma.kfintech.com/